BAG Index (Q4, 2025)

2026-02-13 00:00:00

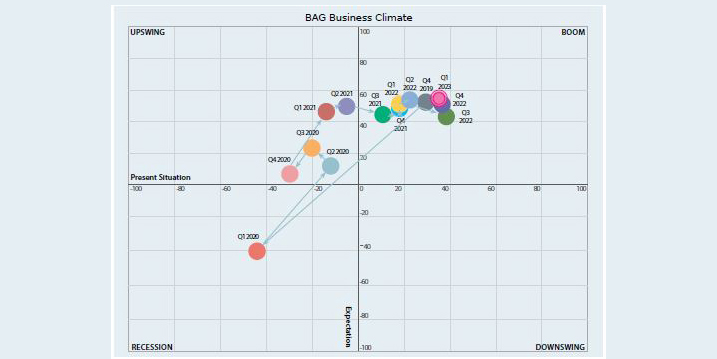

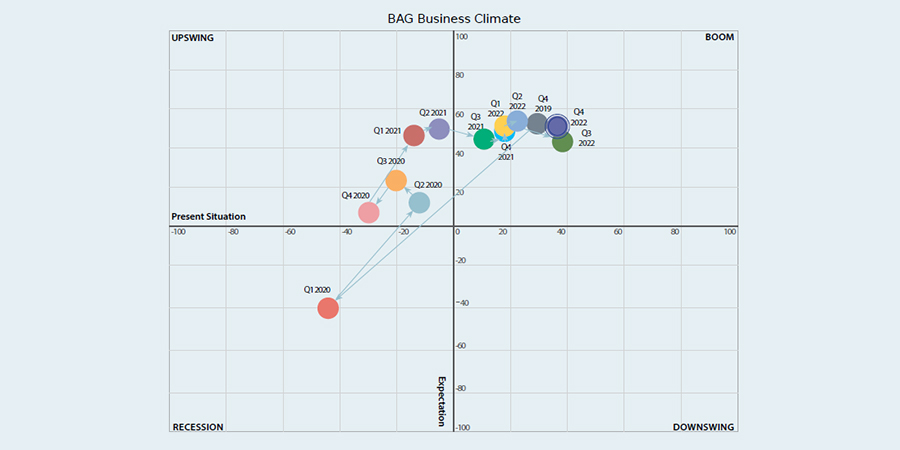

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

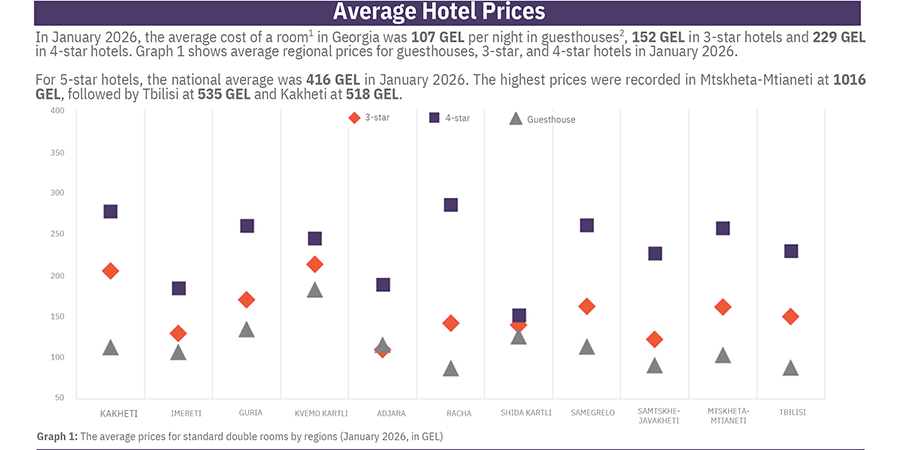

Hotel Price Index (January, 2026)

2026-02-03 00:00:00

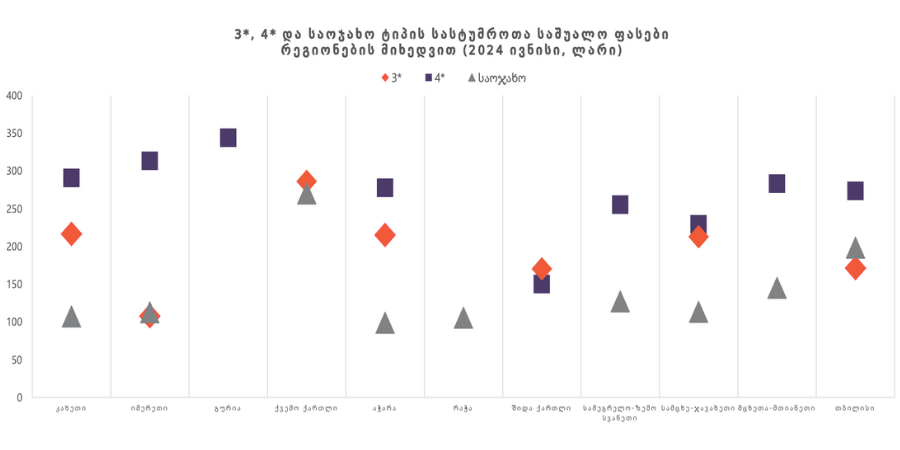

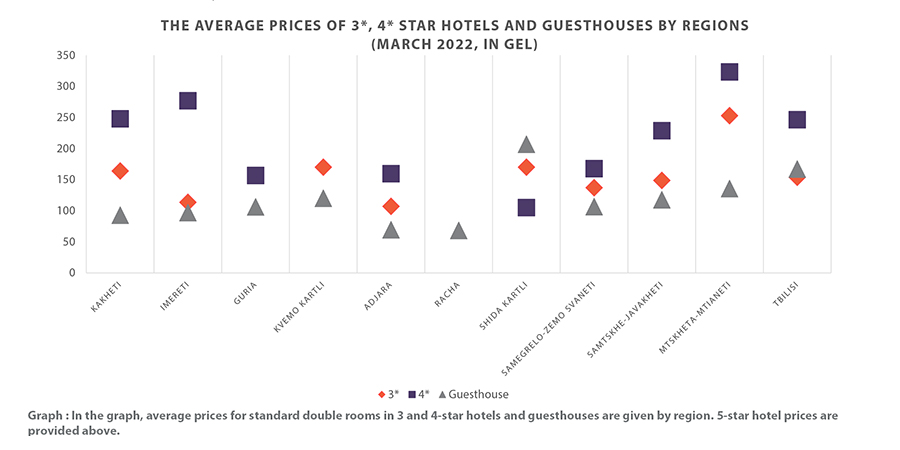

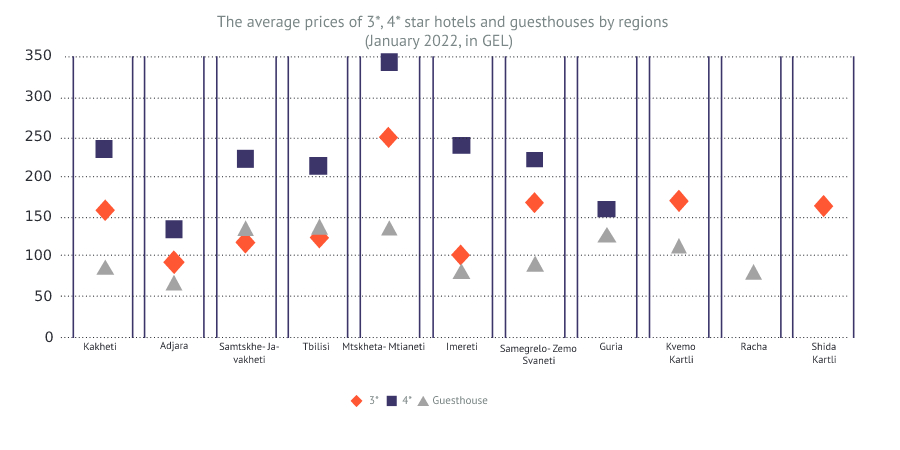

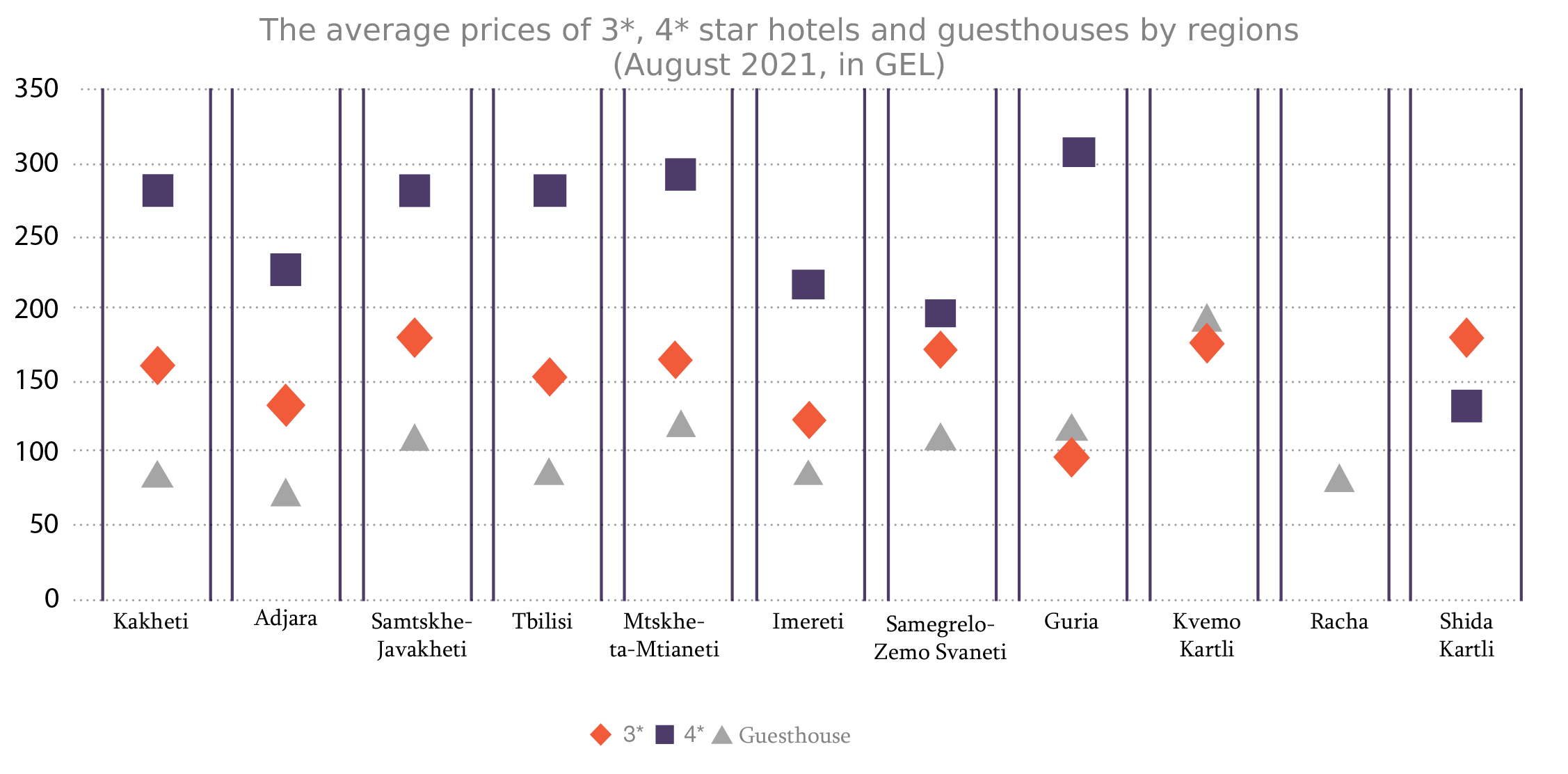

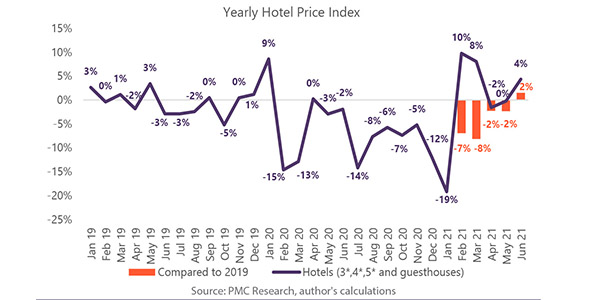

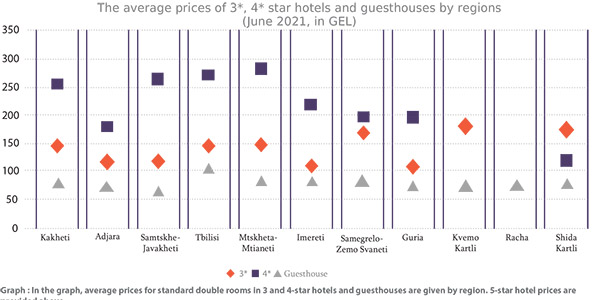

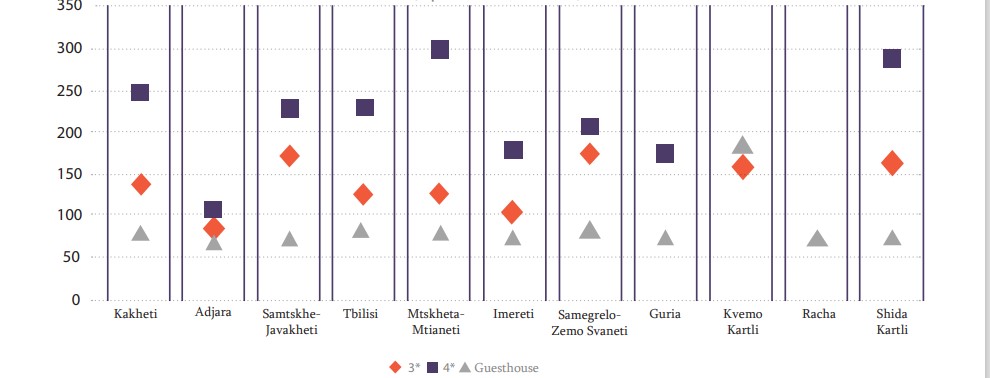

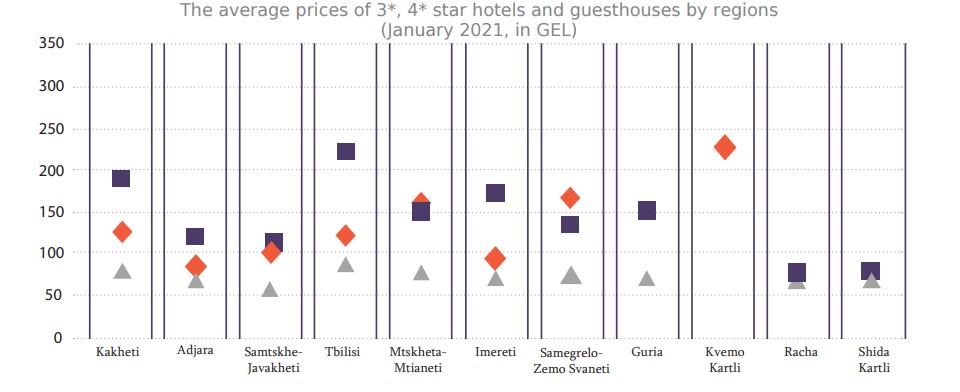

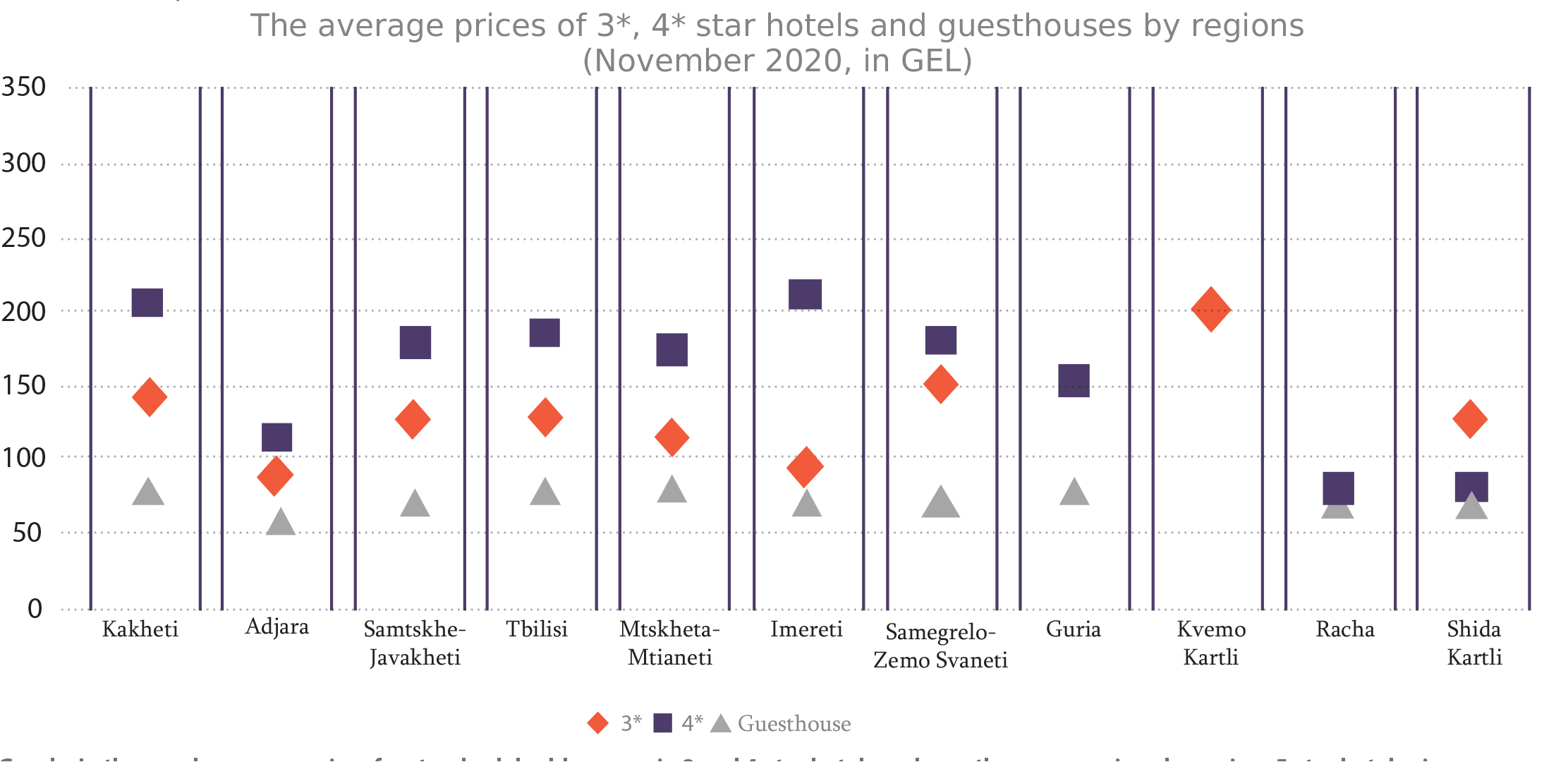

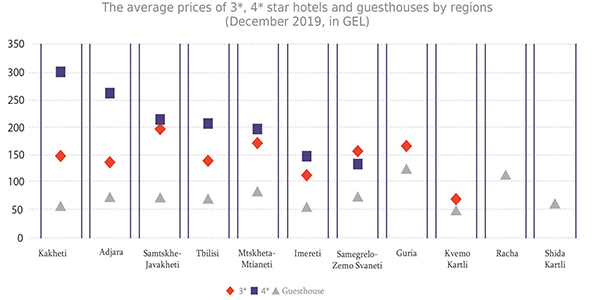

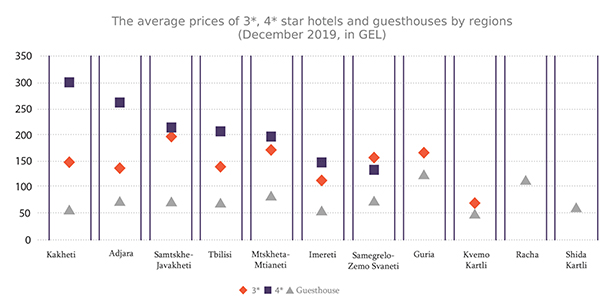

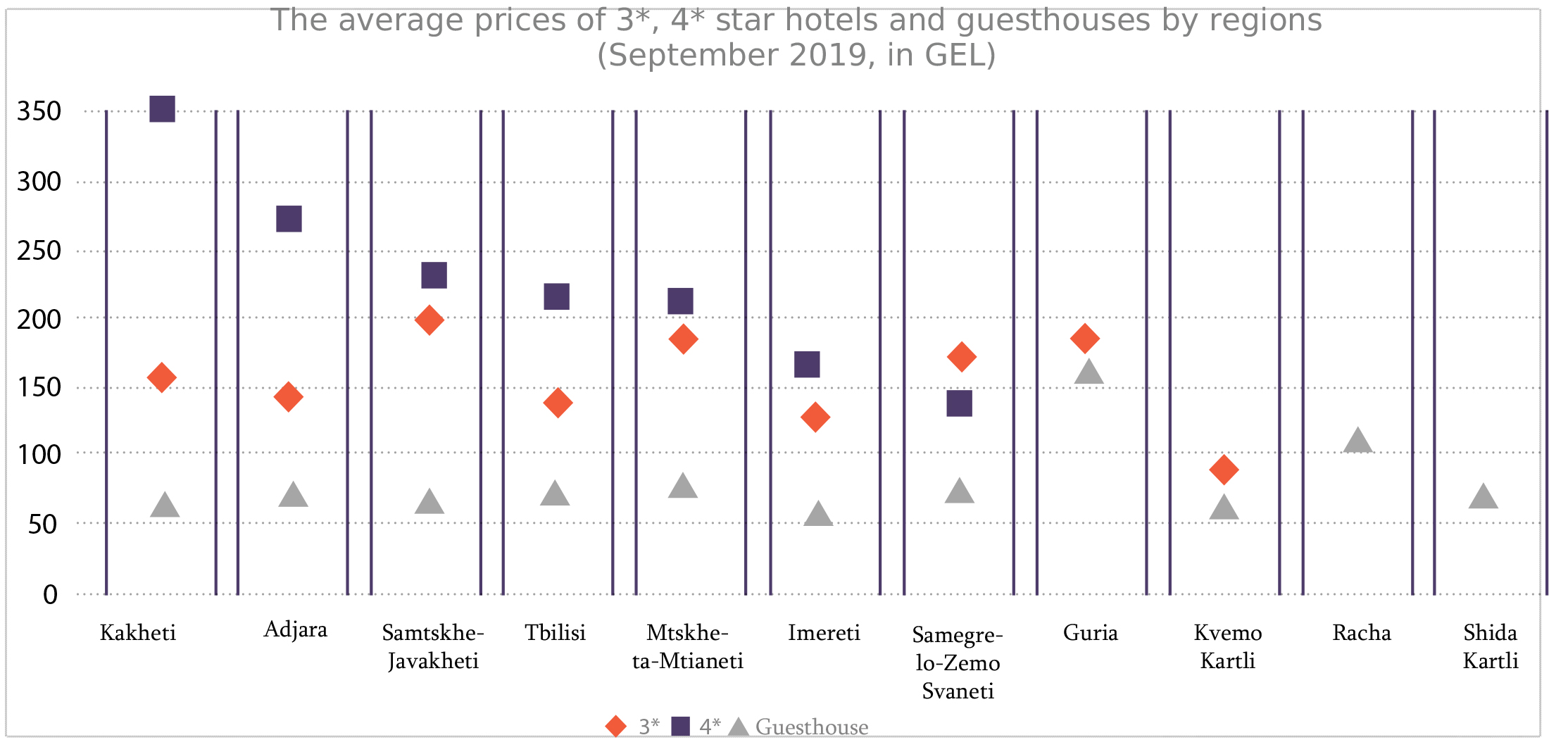

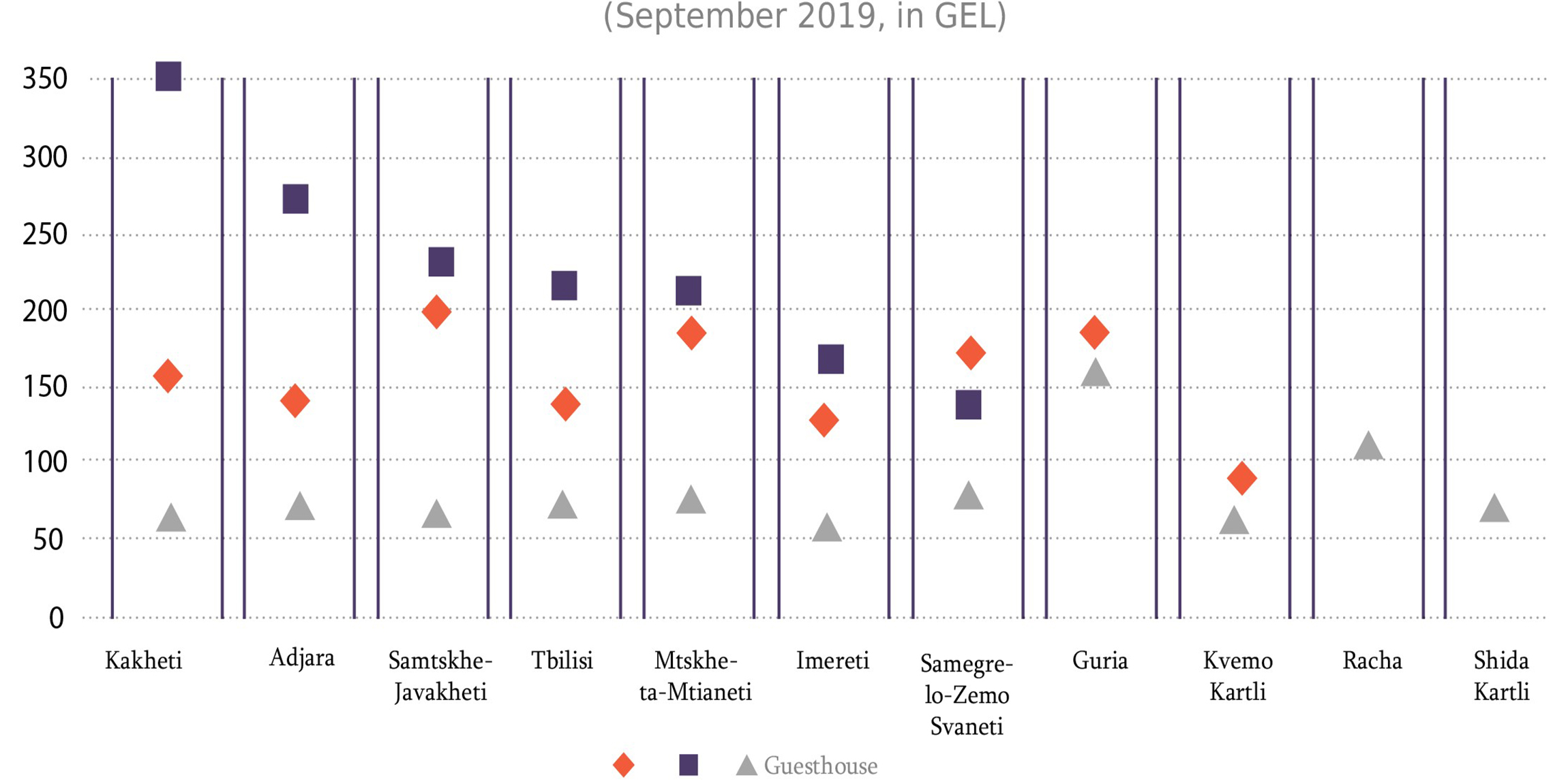

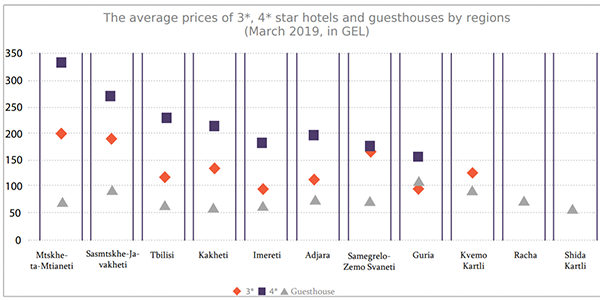

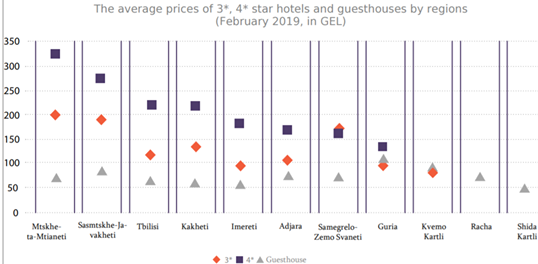

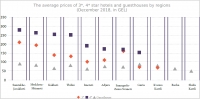

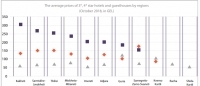

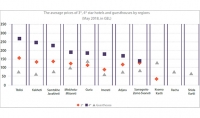

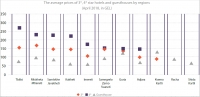

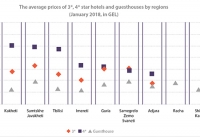

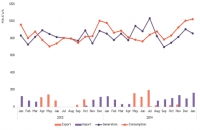

In January 2026, hotel price index in Georgia decreased by 0.8% MoM, with the largest decrease observed in Tbilisi, Samtskhe-Javakheti and Racha compared to previous month.

In January 2026, hotel price index in Georgia increased by 8.9% YoY, with the largest increase in Samtskhe-Javakheti, Shida Kartli, and Adjara.

The average price of a room ranged from 107 GEL to 416 GEL in January 2026.

Employment Tracker (December, 2025)

2026-01-28 00:00:00

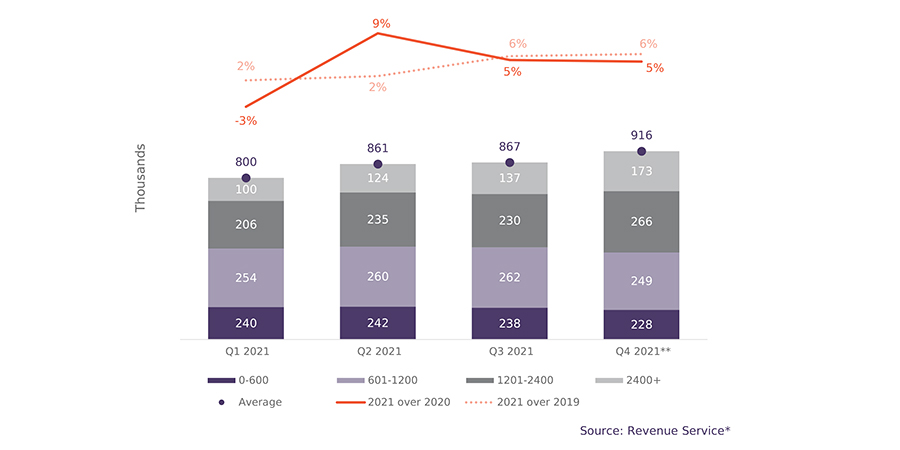

In December 2025, the number of people receiving a monthly salary increased both month-over-month (+2.8%) and year-over-year (+4.3%).

In December 2025, the total number of persons receiving a service fee increased compared to corresponding periods of 2024 (+11.3%) and 2023 (+10.0%).

From October to December 2025, the finance and statistics category contributed the most to the increase in vacancies on jobs.ge compared to the same period in the previous year.

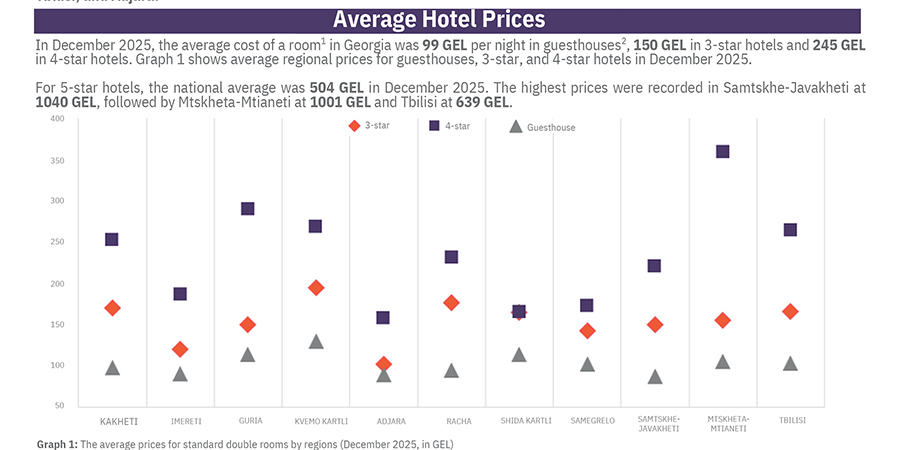

Hotel Price Index (December, 2025)

2026-01-06 00:00:00

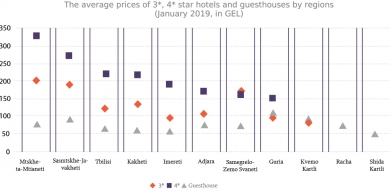

The hotel price index increased for 3-, 4-, 5-star hotels and decreased for guesthouses, both on a MoM and YoY basis.

In December 2025, hotel price index in Georgia increased by 4.3% MoM, with the largest increase in Mtskheta-Mtianeti, Samtskhe-Javakheti, Tbilisi.

In December 2025, hotel price index in Georgia increased by 3.9% YoY, with the largest increase in Samtskhe-Javakheti, Tbilisi, and Adjara.

Employment Tracker (November, 2025)

2025-12-30 00:00:00

In November 2025, the number of persons receiving a salary decreased by 0.8% month-over-month and by 1.0% year-over-year.

In November 2025, vacancies published on Jobs.ge decreased by 14.9% month-over-month, but increased by 5.0% year-over-year due to a low base effect.

From September to November 2025, the category that contributed the most to the year-over-year increase in vacancies was finance and statistics.

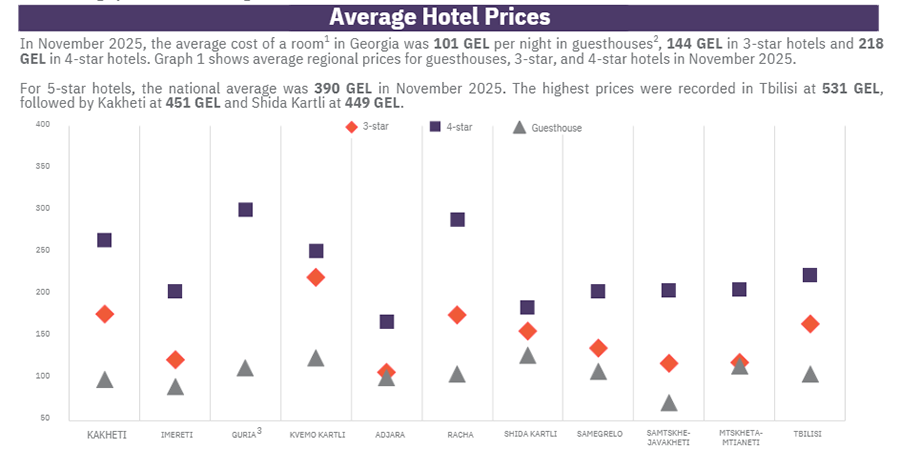

Hotel Price Index (November, 2025)

2025-12-02 00:00:00

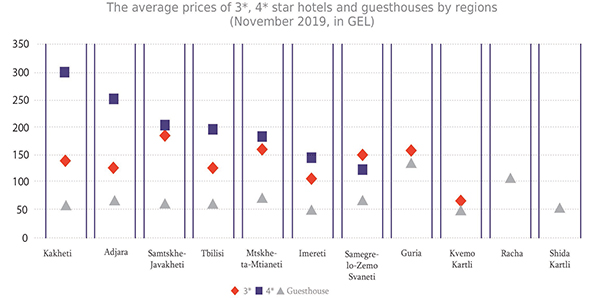

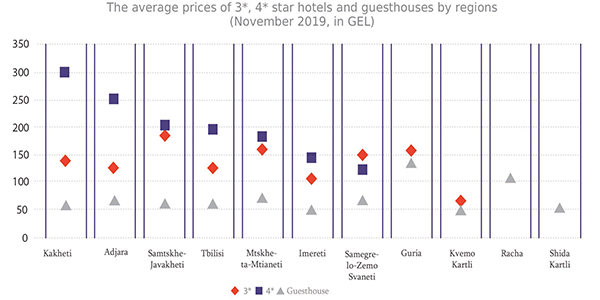

In November 2025, hotel price index in Georgia decreased by 5.9% month-over-month (MoM), with the largest declines in Guria, Tbilisi, and Samtskhe-Javakheti.

In November 2025, hotel price index in Georgia decreased by 4.2% year-over-year (YoY), with the largest declines in Imereti, Kakheti, and Samegrelo-Zemo Svaneti.

The average price of a room ranged from 101 GEL to 390 GEL in November 2025.

Employment Tracker (October, 2025)

2025-11-28 00:00:00

In October 2025, the number of persons receiving a salary increased by 1.9% month-over-month and by 2.6% year-over-year.

In October 2025, vacancies published on Jobs.ge decreased month-over-month by 12.2% and by 2.1% year-over-year.

The number of vacancies in IT and programming category increased the most both year-over-year (+54.8%) and month-over-month (+5.0%) in October 2025.

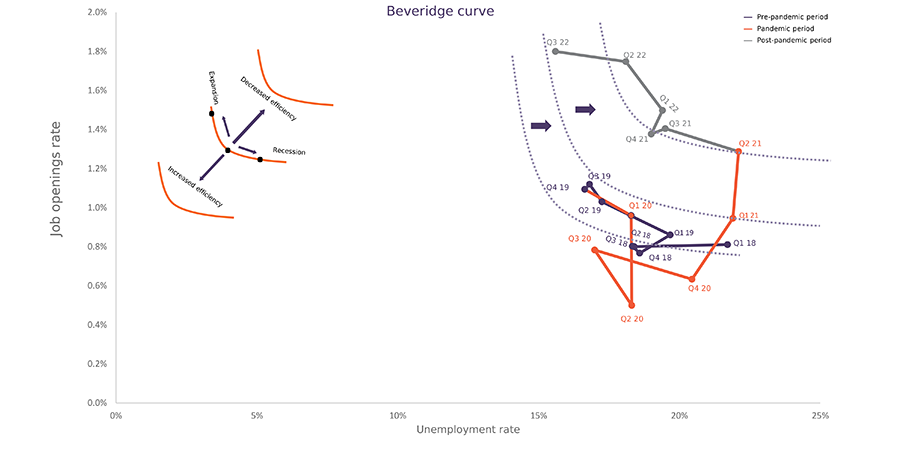

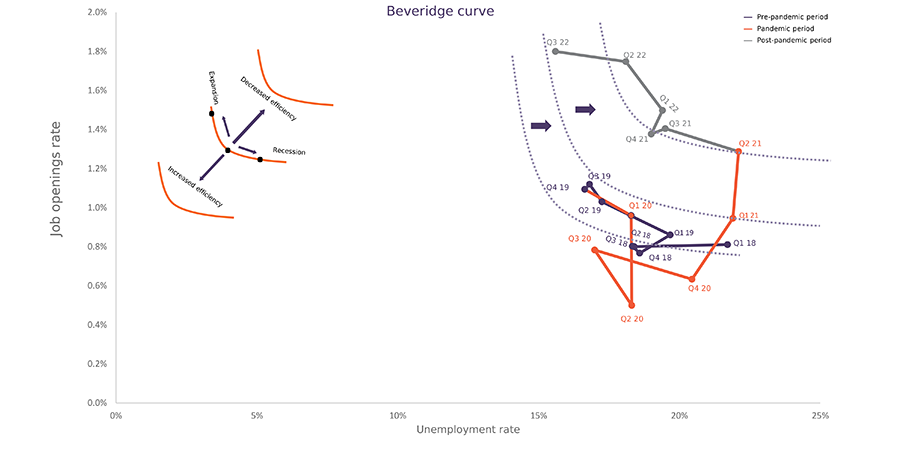

In Q3 2025, compared to Q2 2025, labor market expanded, as seasonally adjusted job opening rate increased and unemployment rate decreased, while labor market efficiency remained unchanged.

Macro Overview: Issue 9

2025-11-19 00:00:00

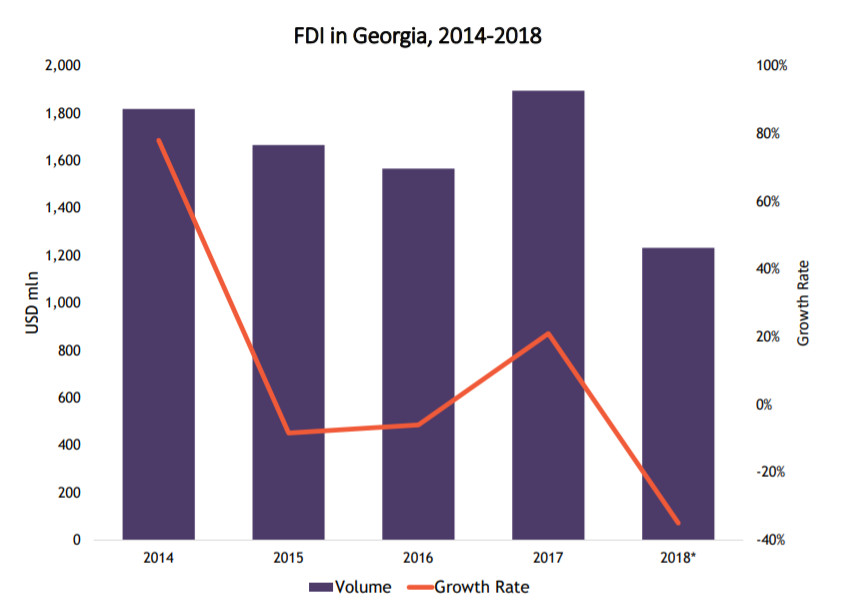

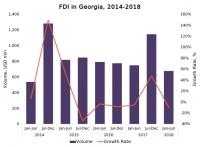

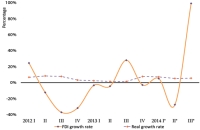

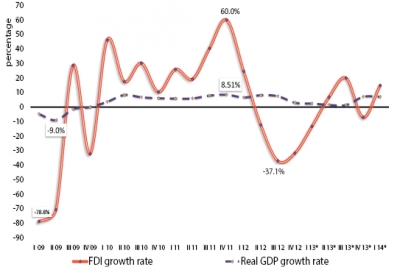

From January to October 2025, Georgia’s economy grew by 7.6%. While YoY growth was robust, it was still below the previous year’s pace. Key growth contributors were the ICT and education sectors, accounting for 22.8% and 12.8% of growth, respectively. Services exports and other external inflows supported economic activity, with total FDI increasing by 11.0% YoY and tourism revenues rising by 5.1% YoY.

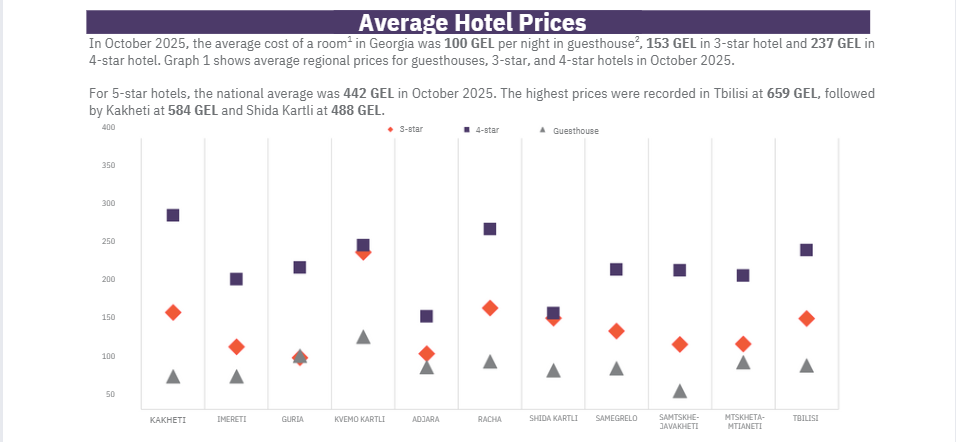

Hotel Price Index (October, 2025)

2025-11-06 00:00:00

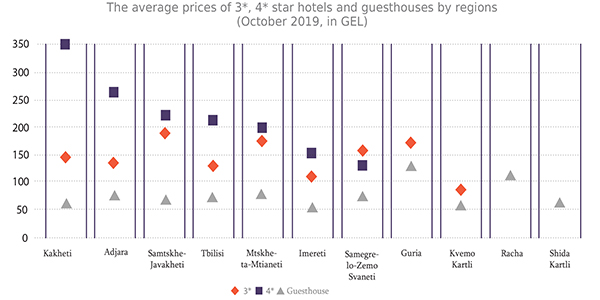

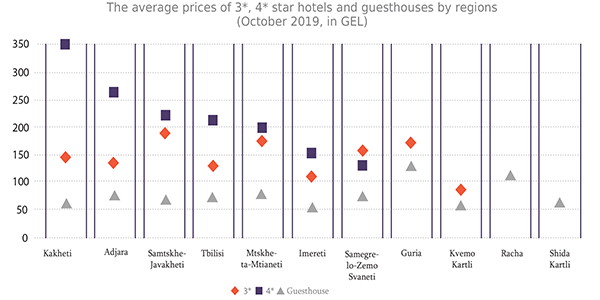

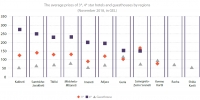

In October 2025, hotel price index in Georgia decreased by 9.6% month-over-month (MoM), with the largest declines in Adjara,Guria, and Kakheti.

In October 2025, hotel price index in Georgia decreased by 2.3% year-over-year(YoY), with the largest declines in Mtskheta-Mtianeti, Samegrelo-ZemoSvaneti, and Kakheti.

The average price of a room ranged from 100 GEL to 442 GEL in October 2025.

Employment Tracker (September, 2025)

2025-10-30 00:00:00

In September 2025, the number of people receiving a monthly salary increasedby 4.9%month-over-month and by 2.6% year-over-year.

The total number of vacancies published on Jobs.ge increased month-over-month (+20.0%) and year-over-year (+4.7%).

Over the past three months, the number of vacancies on Jobs.gein logistics declined by 4.5%, while those in management fell by 4.4% compared to the same period in 2024.

BAG Index (Q3, 2025)

2025-10-27 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

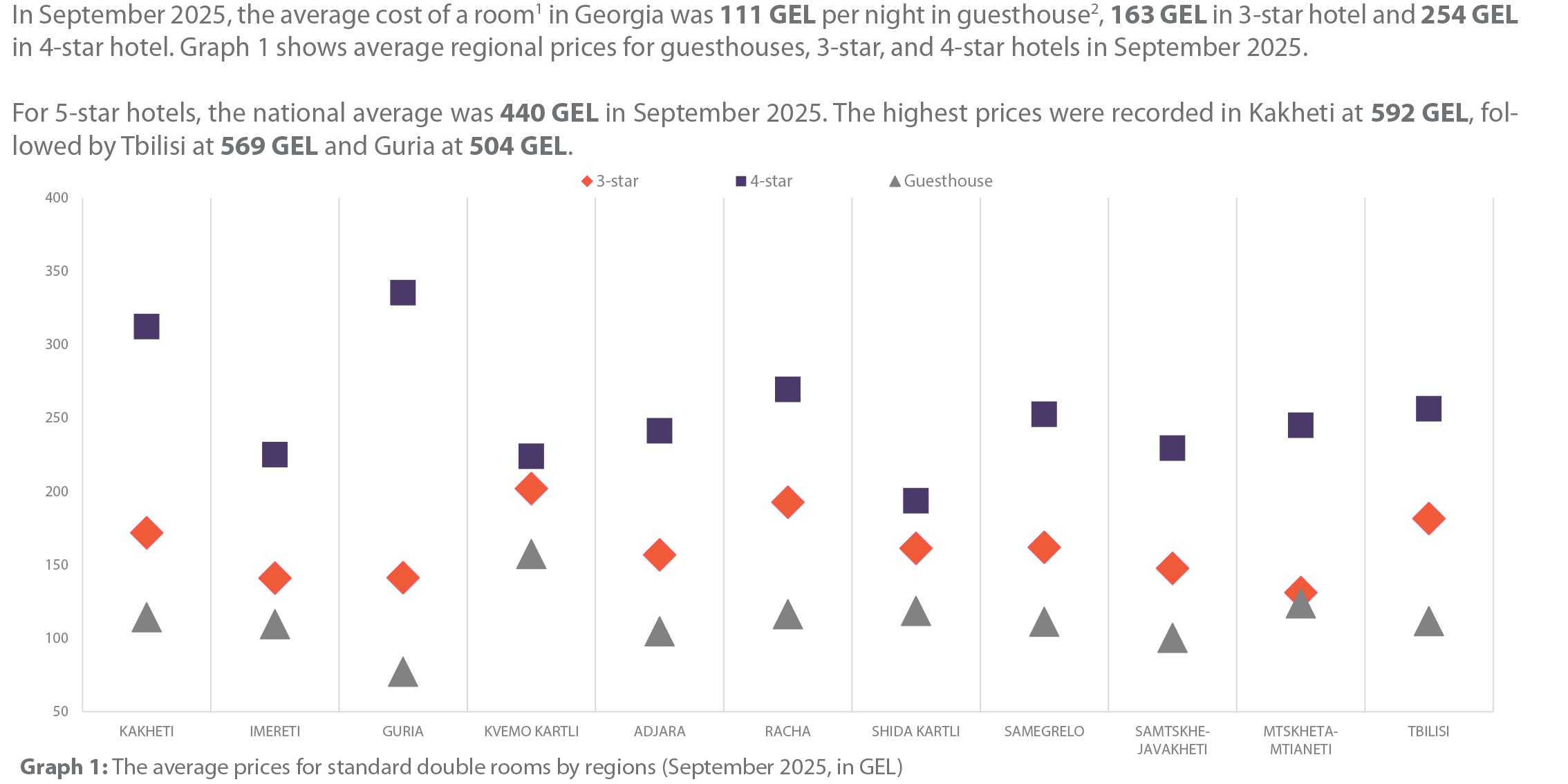

Hotel Price Index (September, 2025)

2025-10-06 00:00:00

• In September 2025, hotel price index in Georgia decreased by 9.2% month-over-month (MoM), with the largest declines in Guria, Adjara and Samtskhe-Javakheti.

• In September 2025, hotel price index in Georgia decreased by 1.8% year-over-year (YoY), with the largest declines in Adjara, Tbilisi and Kakheti.

• The average price of a room ranged from 111 GEL to 440 GEL in September 2025.

Employment Tracker (August, 2025)

2025-10-01 00:00:00

In August 2025, the number of persons receiving a monthly salary declined by 5.7% month-over-month but rose by 2.6% year-over-year.

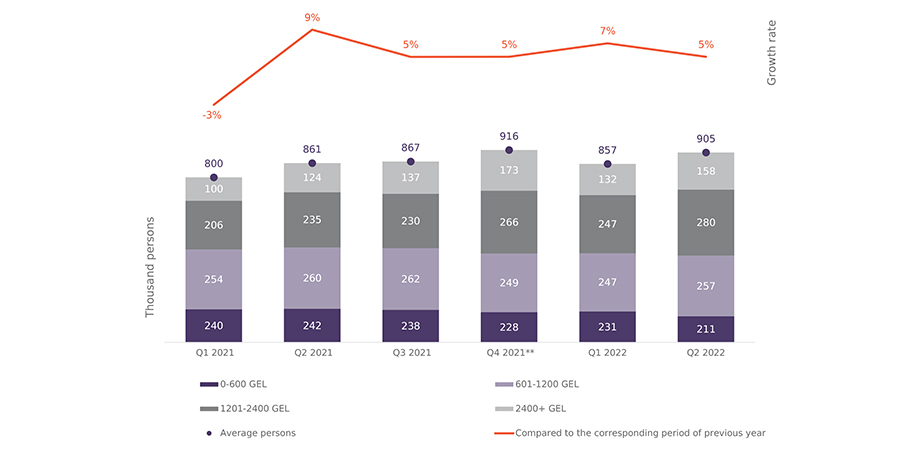

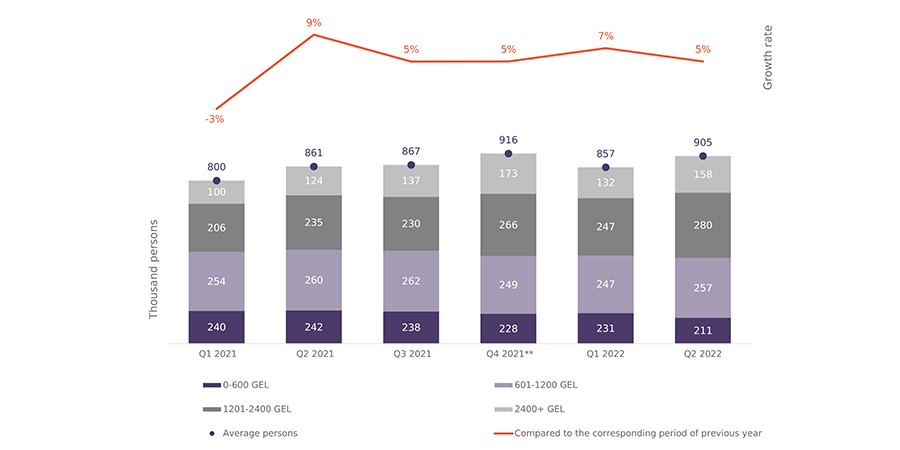

In August 2025, the share of employees earning 2,400 GEL or more fell to 33.1%, while the share earning up to 600 GEL rose to 13.5%, month-over-month.

Vacancies published on Jobs.ge decreased month-over-month by 11.0% and increased by 3.0% year-over-year.

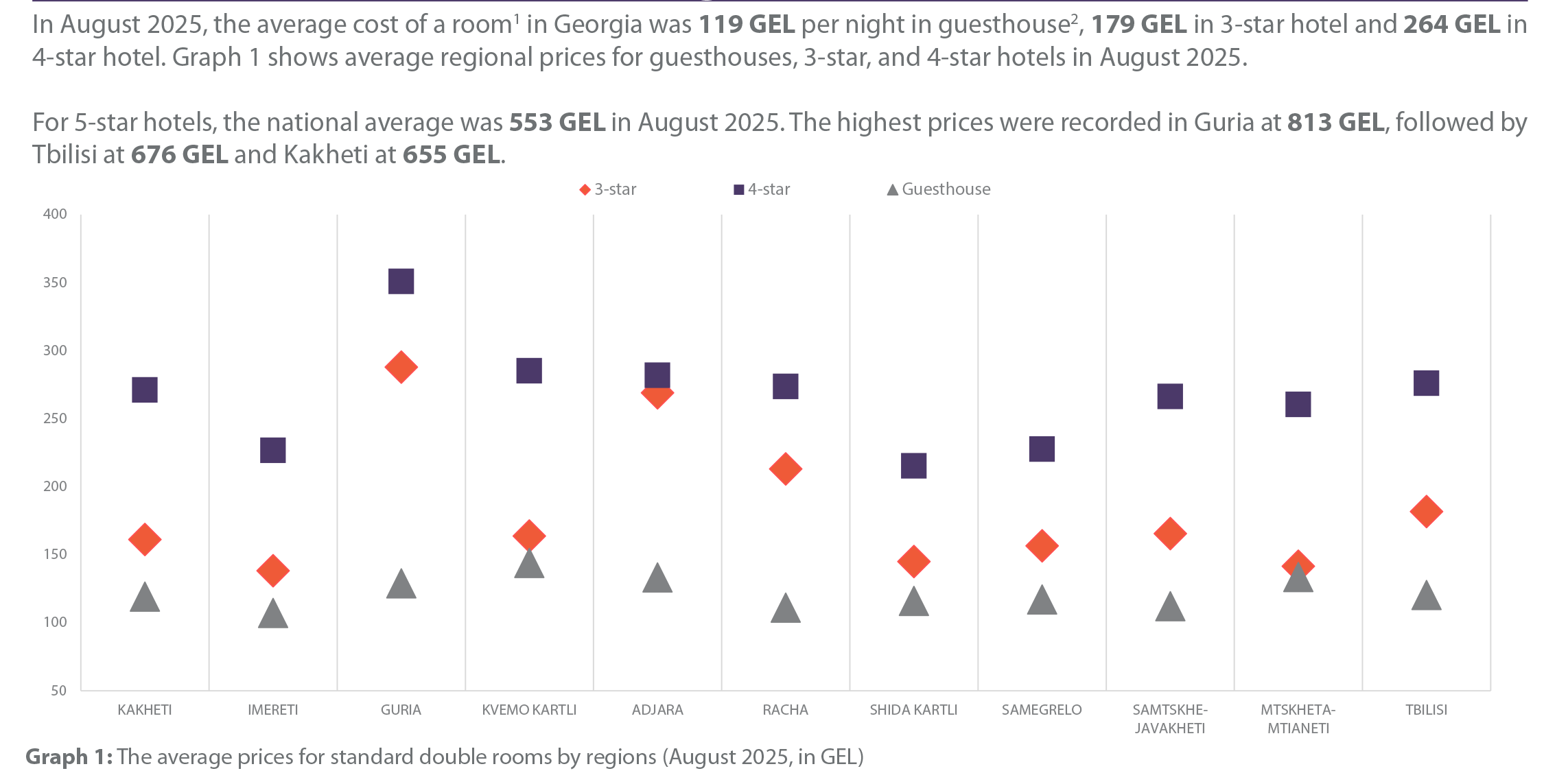

Hotel Price Index (August, 2025)

2025-08-25 00:00:00

• In August 2025, hotel price index in Georgia increased by 3.5% month-over-month (MoM), with the highest growth recorded in Guria, Adjara and Racha. • In August 2025, hotel price index in Georgia increased by 1.1% year-over-year (YoY), with the highest growth recorded in Samtskhe-Javakheti, Shida Kartli and Racha. • Both MoM and YoY growth was mainly driven by rising guesthouse prices in August 2025• The average price of a room ranged from 119 GEL to 553 GEL in August 2025.

Employment Tracker (July, 2025)

2025-08-01 00:00:00

In July 2025, the number of persons receiving a salary of 2,400 GEL or more exceeded the number of persons receiving a salary between 1,200 and 2,399 GEL.

In July 2025, the highest growth in the number of vacancies on jobs.ge was recorded in IT and programming category, both month-over-month (+11.1%) and year-over-year (+26.8%).

In Q2 of 2025, compared to Q1 2025, the efficiency of the labor market remained unchanged, as neither the job openings rate nor the unemployment rate showed a statistically significant change.

Hotel Price Index (July, 2025)

2025-08-01 00:00:00

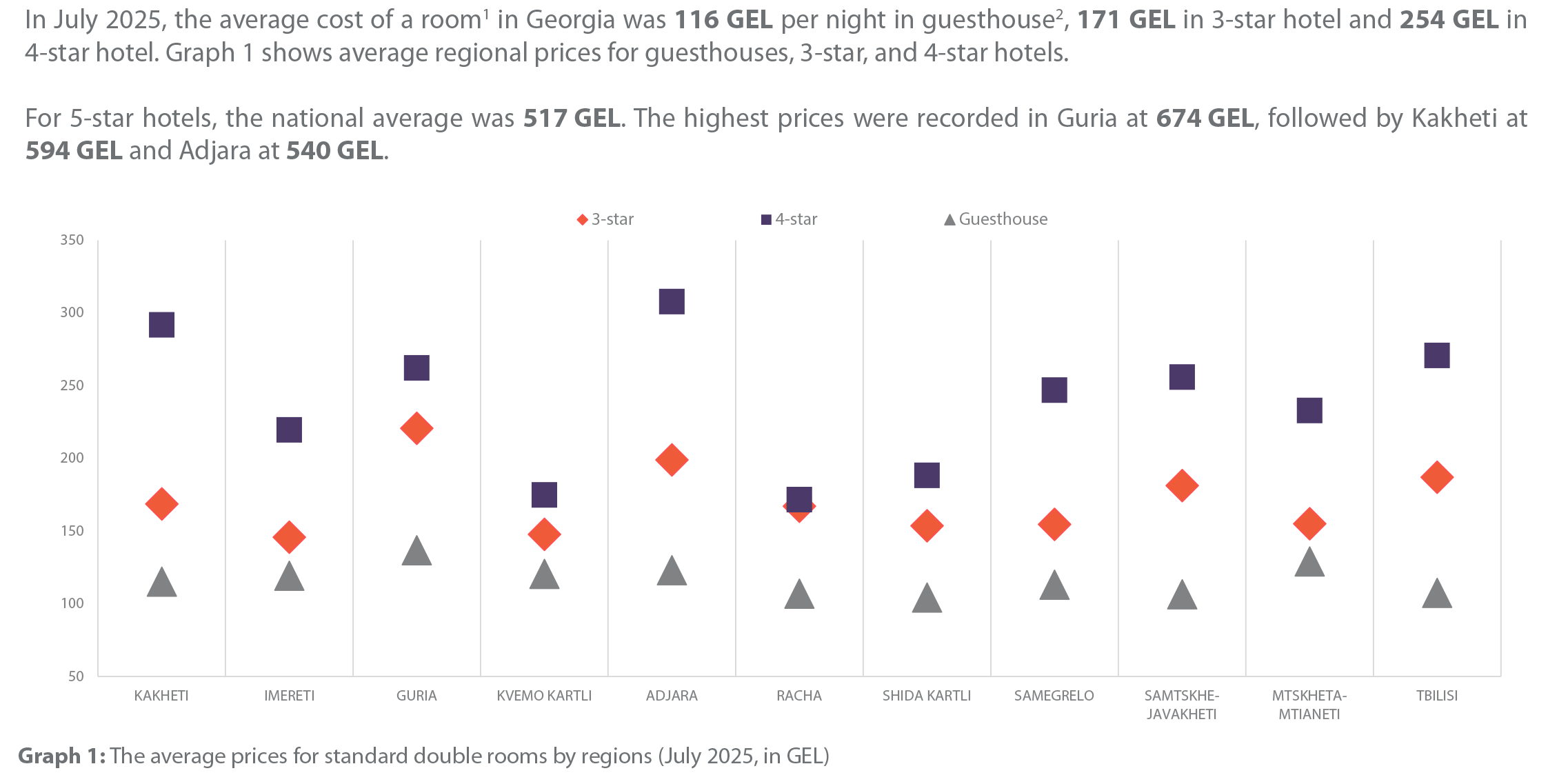

• In July 2025, hotel prices in Georgia increased month-over-month (MoM), with the highest growth recorded in Guria and Adjara, followed by Tbilisi.

• In July 2025, hotel prices remained unchanged year-over-year (YoY), as decreases in 3-, 4-, and 5-star hotel prices were offset by increases in guesthouse prices.

• The average price of a room ranged from 116 GEL to 517 GEL in July 2025.

Employment Tracker (June, 2025)

2025-07-30 00:00:00

In June 2025, the number of persons receiving a monthly salary increased by 0.5% month-over-month (MoM) and by 3.4% year-over-year (YoY).

In June 2025, the share of persons receiving a monthly salary of 2,400 GEL or more amounted to 32.8%, up 0.9 percentage points MoM and 6.6 percentage points YoY.

In June 2025, the number of jobs published on Jobs.ge increased by 6.4% MoM but decreased by 1.0% YoY.

Employment Tracker (May, 2025)

2025-07-02 00:00:00

In May 2025, the number of persons receiving a monthly salary increased by 1.5% YoY. However, the YoY growth rate slowed by 2.8 percentage points compared to May 2024.

In May 2025, the share of persons receiving a monthly salary of 2,400 GEL or more increased by 4.9 percentage points YoY, while the share of those receiving up to 600 GEL declined by 2.3 percentage points.

In May 2025, the total number of vacancies published on jobs.ge declined by 5.1% YoY, but increased by 10.8% MoM.

BAG Index (Q2, 2025)

2025-06-26 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

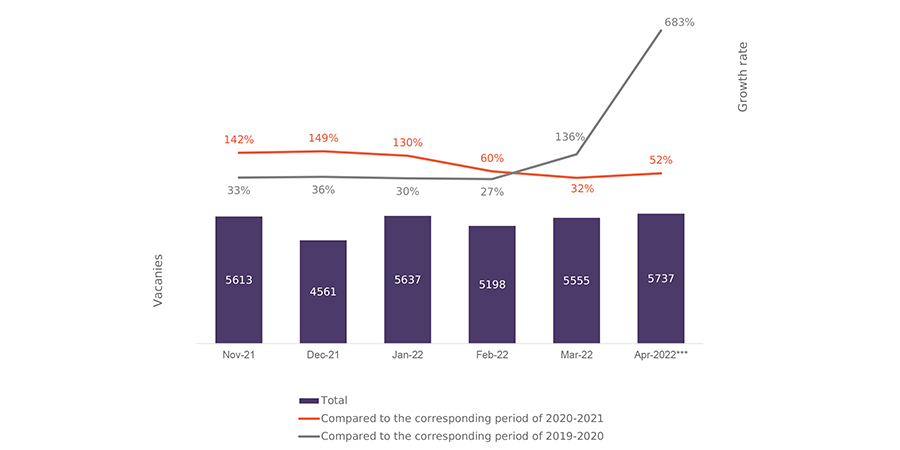

Issue 151: Labour Market Overview

2025-06-19 00:00:00

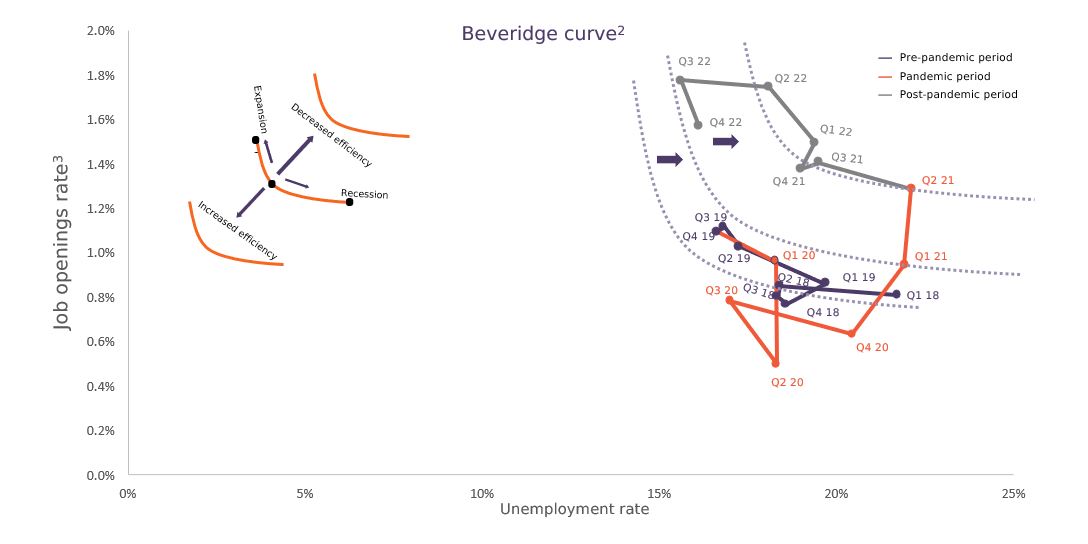

The latest issue of Economic Outlook and Indicators in Georgia highlights recent improvements in the labor market while also addressing emerging challenges. In this bulletin, we explore key labor market developments and provide a comprehensive overview, including:

• Key labor market indicators

• Beveridge curve analysis

• Employment by economic sectors and foreign nationals

• Salaries of paid employees

• Vacancies posted on Jobs.ge

Employment Tracker (April, 2025)

2025-05-27 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In April 2025, the number of persons receiving a monthly salary saw an increase of 2.2% compared to the same period of 2024. However, the YoY growth rate slowed by 2.6 percentage points compared to April 2024.

In April 2025, the total number of vacancies posted on jobs.ge decreased by 16.6% YoY.

Over the past 3 months (from February 2025 to April 2025), the administration and management category saw the largest YoY decrease (–21.8%), contributing the most to the overall decline.

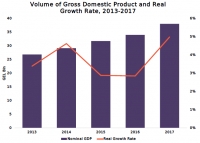

Issue 8: Macro Overview

2025-05-21 00:00:00

Georgia’s economy demonstrated robust average YoY growth of 9.3% in Q1 of 2025 (rapid estimate), sustaining strong momentum after 9.5% growth in 2024.

Issue 8 of the Macro Overview examines key aspects of Georgia’s economy and beyond, including:

• Economic Growth;

• Economic and Business Climate;

• Key Macroeconomic Indicators;

• Labor Market;

• External Sector;

• Global Economic Trends.

Beverage Manufacturing in Georgia

2025-05-01 00:00:00

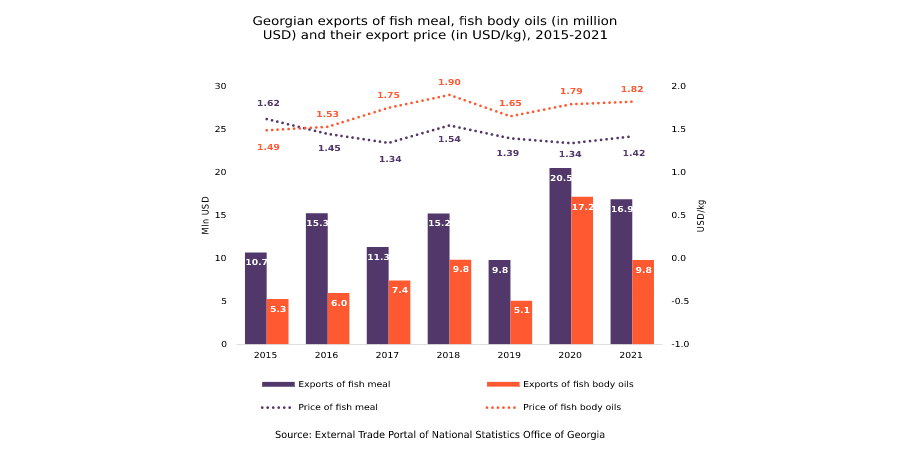

The beverage manufacturing sector, encompassing the production of fruit juices, mineral water, soft drinks, beer, and spirits, has high export potential and a strong presence of small and medium-sized enterprises (SMEs).

From 2017 to 2023, Georgia’s total beverage exports grew at a CAGR of 10%, reaching USD 463 million in 2023. Despite overall export growth, the share of exports to the EU declined significantly during this time, particularly for SMEs.

Key challenges include limited access to quality raw materials, outdated machinery, a shortage of skilled labor, and logistical constraints, as well as difficulties in meeting EU standards and DCFTA regulations and limited access to financing for export operations.

Employment Tracker (March, 2025)

2025-04-24 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In March 2025, the number of persons receiving a monthly salary saw a modest increase of 0.3% compared to the same period in 2024.

In March 2025, the total number of vacancies posted on jobs.ge decreased by 18% YoY.

The administration and management category contributed the most to the decline in vacancies from January to March 2025.

IT Services in Georgia

2025-04-10 00:00:00

Georgia’s IT services sector has experienced rapid expansion, with tax revenues quadrupling between 2020 and 2023, employment increasing 5.4-fold, and turnover rising 13-fold.

Government policies and incentives, such as the International Company Status and FDI Grant Program, have played a key role in attracting foreign investment and driving the sector’s development.

Future growth will rely on strategic initiatives such as the successful implementation of GITA 2.0, enhanced IT procurement policies, and stronger collaboration with the private sector, while addressing key challenges like export capabilities and talent retention.

Reshaping Maritime Trade in the Black Sea: The Effects of the Russo-Ukrainian War

2025-03-31 00:00:00

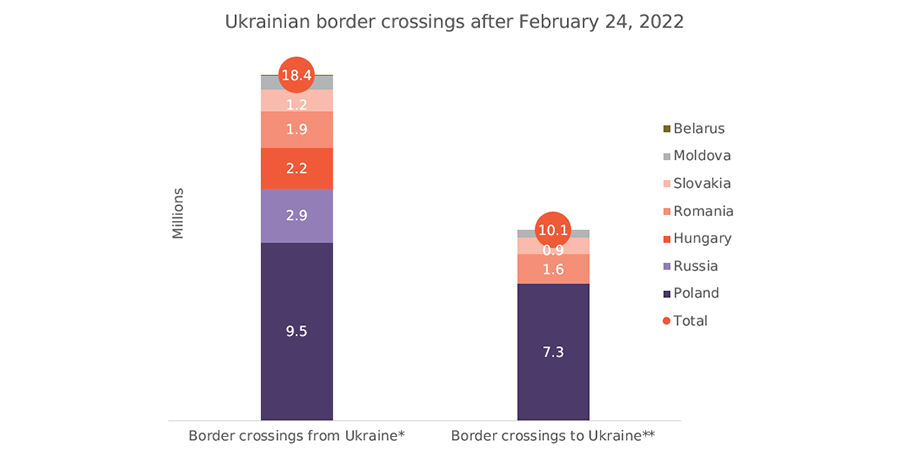

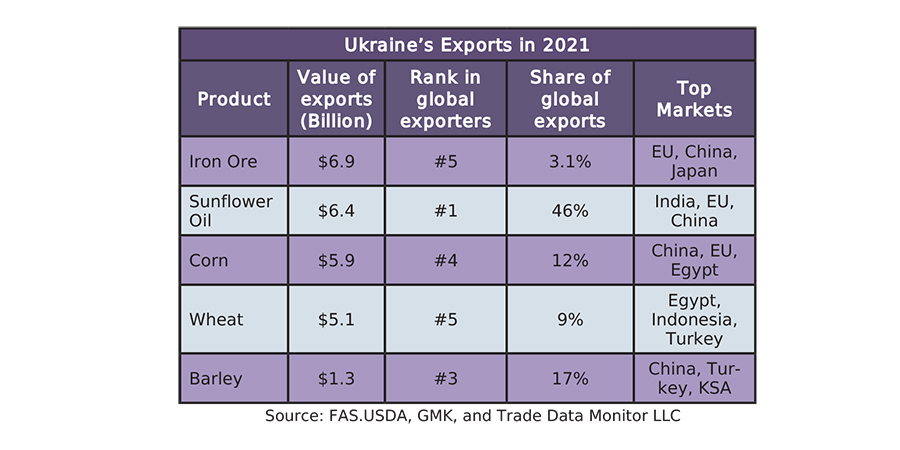

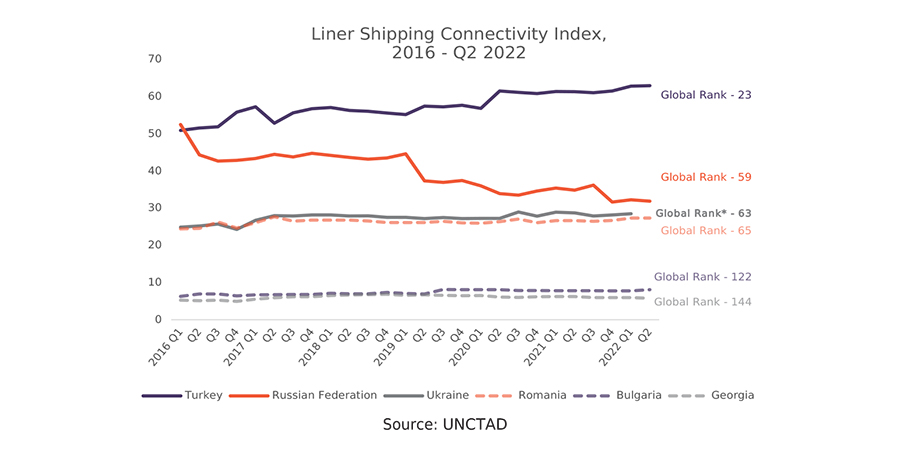

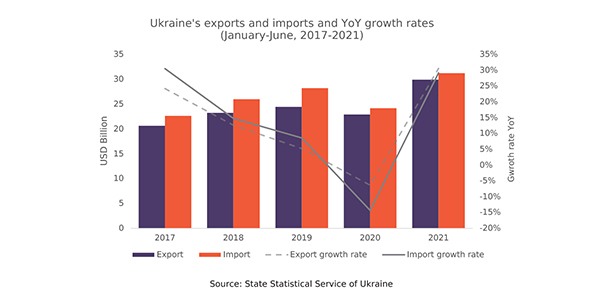

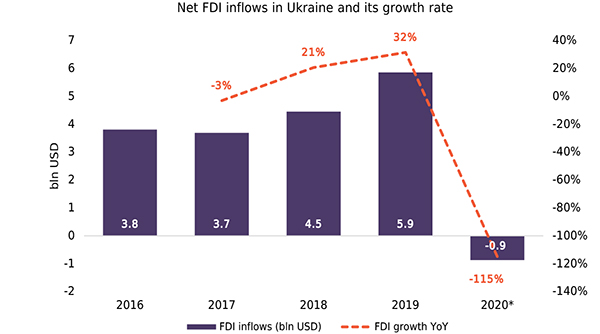

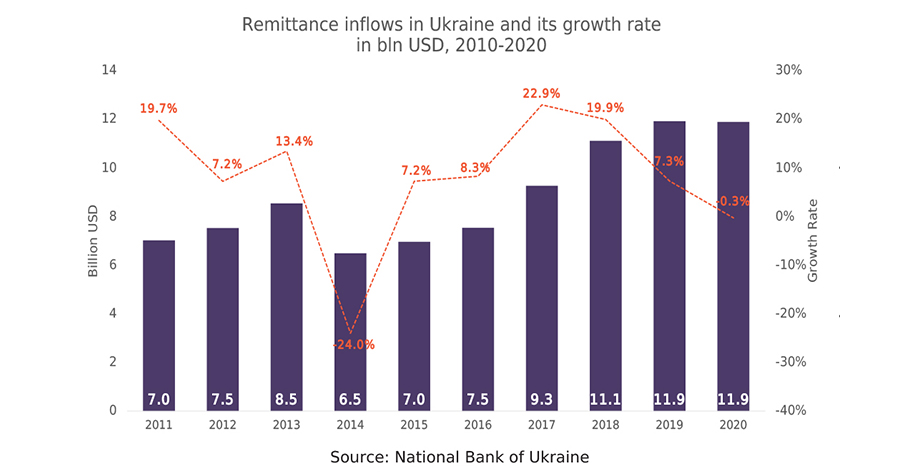

Shortly after Russia’s full-scale invasion of Ukraine in February 2022, maritime trade flows in the Black Sea were significantly reshaped. As the war continued, developments affecting the trade in the Black Sea changed, underscoring the importance of thoroughly analyzing how the region has adapted to such disruptions. This publication builds upon the previous edition, which was released shortly after the outbreak of the war. Now, three years later, our focus shifts to examining how trade dynamics, particularly maritime trade in the Black Sea region, have evolved during this period.

Key insights include:

Upon the outbreak of the Russo-Ukrainian War, port calls in Ukraine and Russia dropped sharply, while other Black Sea countries briefly benefited from redirected trade flows. By late 2023, port calls in Ukraine had gradually recovered, supported by new shipping routes through Romania and Bulgaria. However, serious threats to commercial shipping remained.

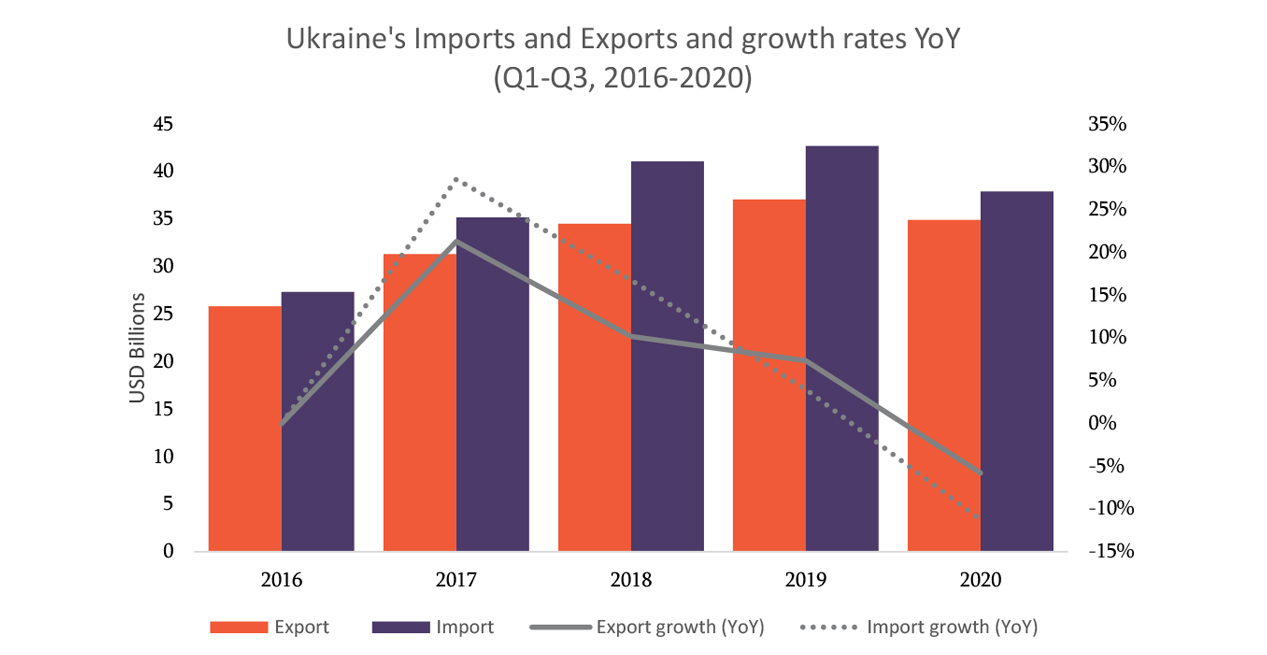

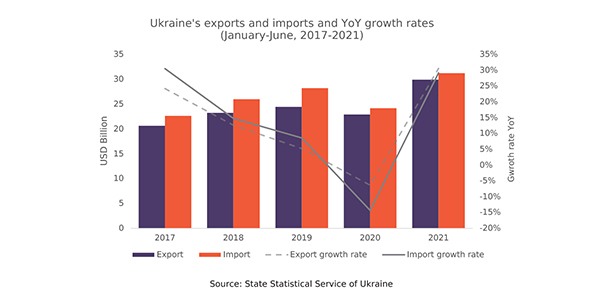

Ukraine’s maritime exports and imports fell sharply in 2022, with a slow recovery in imports in 2023. In Russia, maritime imports declined, while exports initially increased in 2022, possibly due to sanctions being ineffective. However, as the sanctions intensified, exports also fell significantly the following year.

Employment Tracker (February, 2025)

2025-03-26 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In February 2025, the annual growth in the number of salaried employees recorded its lowest rate since 2023.

In February 2025, the total number of vacancies posted on jobs.ge decreased by 20% YoY.

Between December 2024 and February 2025, the Sales and Procurement category saw the highest number of job postings.

Quarterly Tourism Update (Tourism Indicators in 2024)

2025-03-18 00:00:00

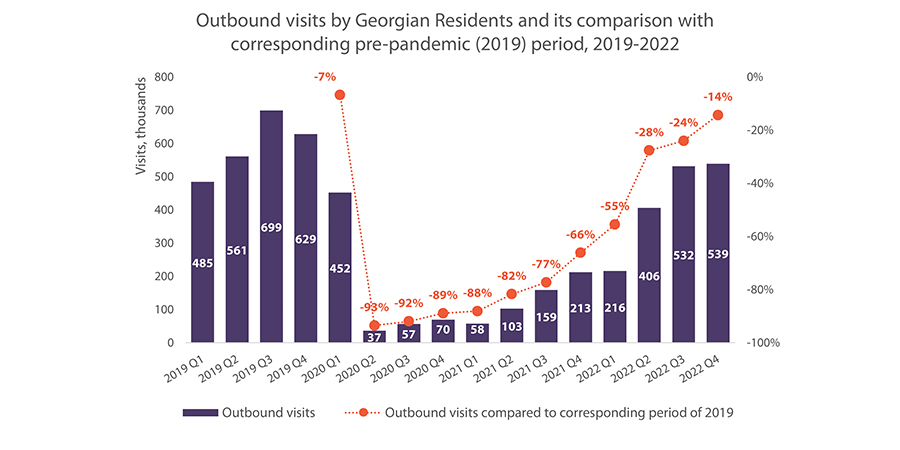

In 2024, a total of 6.5 million international visits to Georgia were recorded, a 4.6% increase YoY, driven by a 9.0% rise in overnight trips, while same-day trips declined by 9.2%.

In 2024, visits from the EU and the UK totaled 438,414, a 3.8% increase YoY. However, the number of visits from the EU and the UK declined every quarter from Q1 of 2024 onwards.

In 2024, there were 2.2 million outbound visits made by Georgian residents, a marginal 0.1% increase YoY. Notably, outbound visits declined YoY in both Q3 and Q4 of 2024.

Foreign Assistance to Ukraine (2022-2024)

2025-03-10 00:00:00

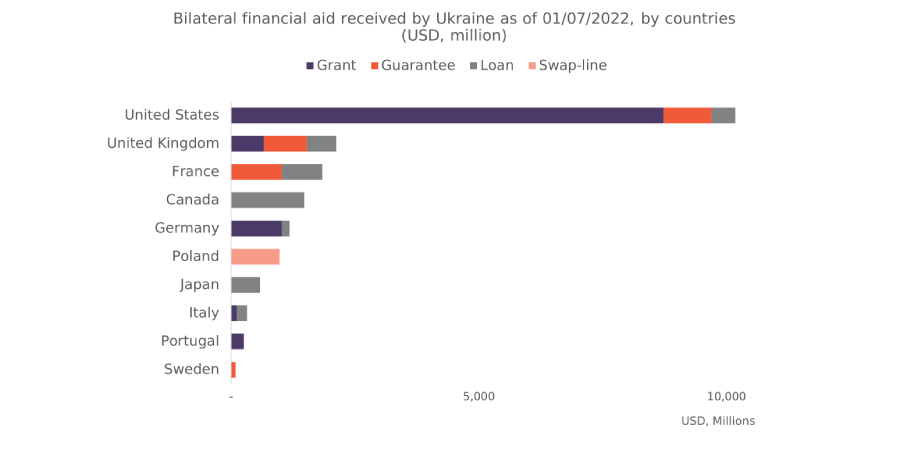

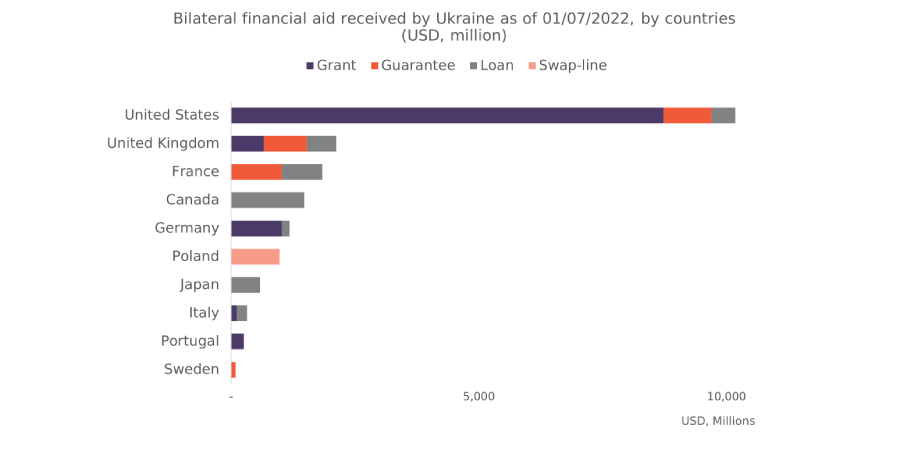

From the beginning of the war in February 2022 up until 31 December 2024, the international community has committed a total of €399.8 billion to Ukraine, with the majority (52%) designated for financial assistance, 42% for military assistance, and 6% for humanitarian assistance.

Of the committed assistance, 67% (€267.2 billion) has already been allocated.

The US leads the way in terms of total commitments, with 96% of its pledged assistance already allocated.

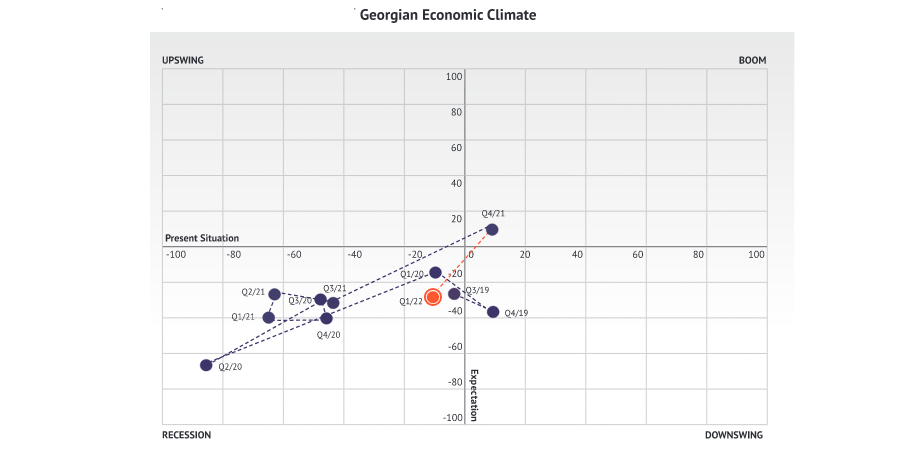

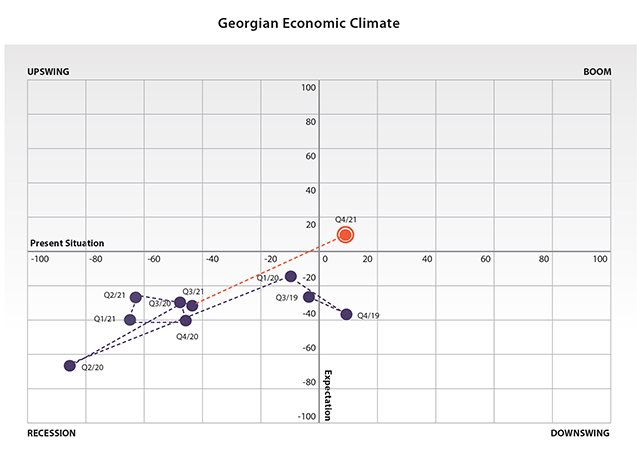

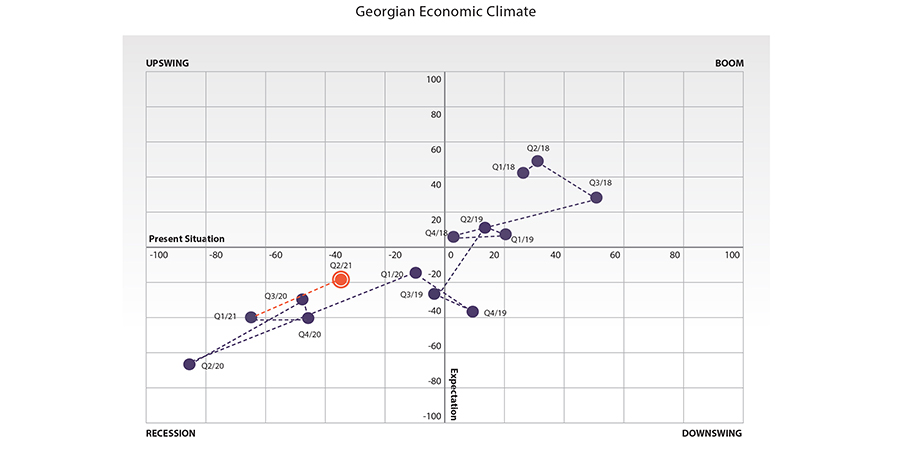

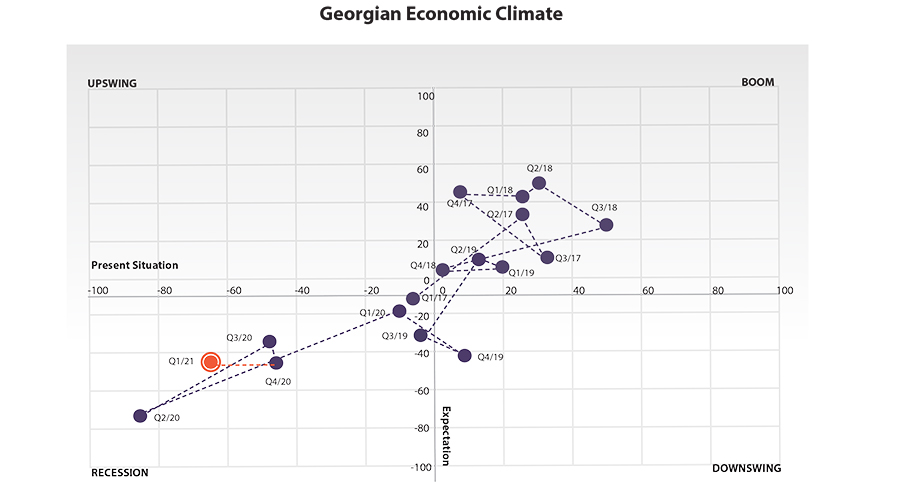

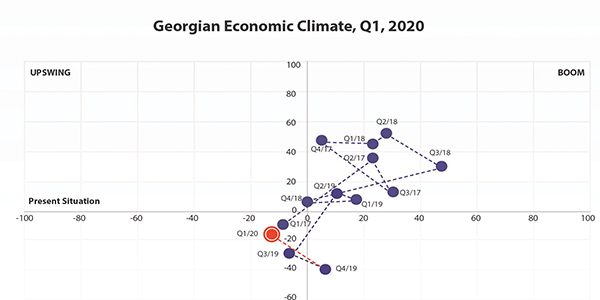

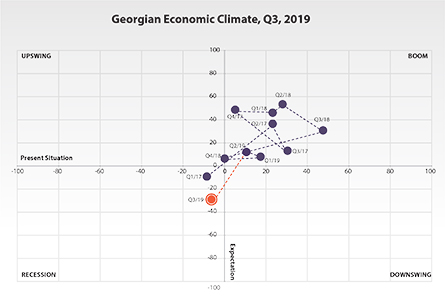

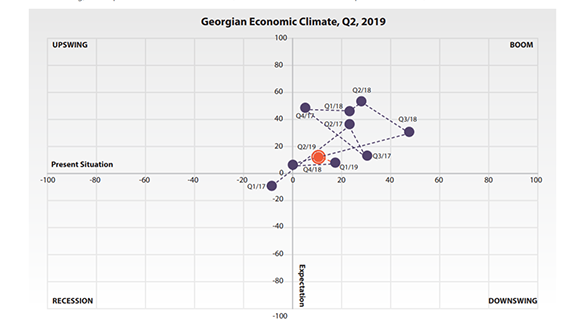

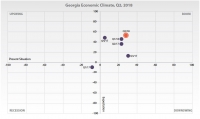

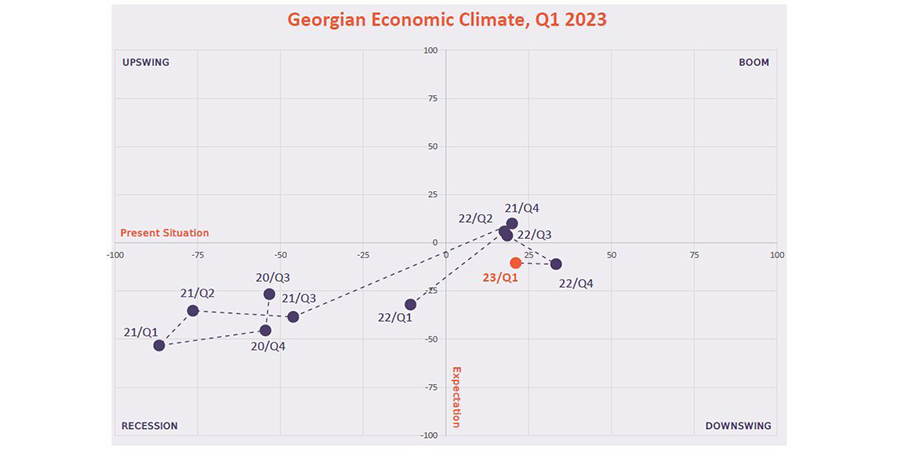

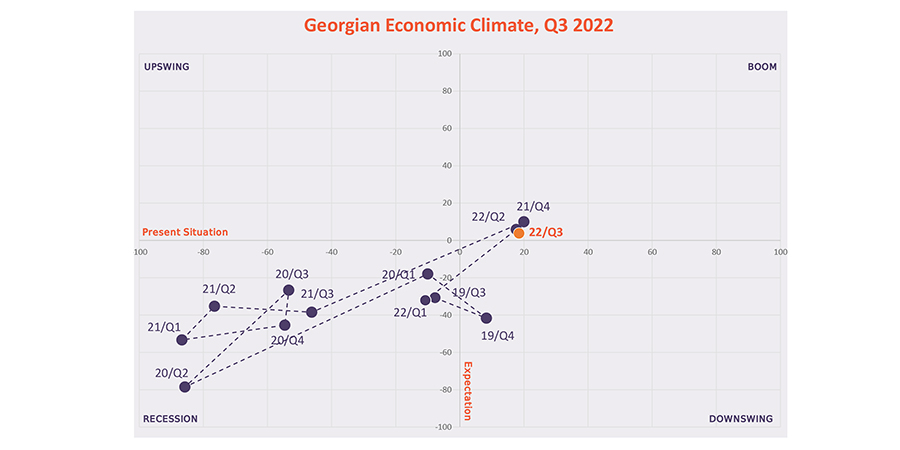

Georgian Economic Climate (Q1, 2025)

2025-03-06 00:00:00

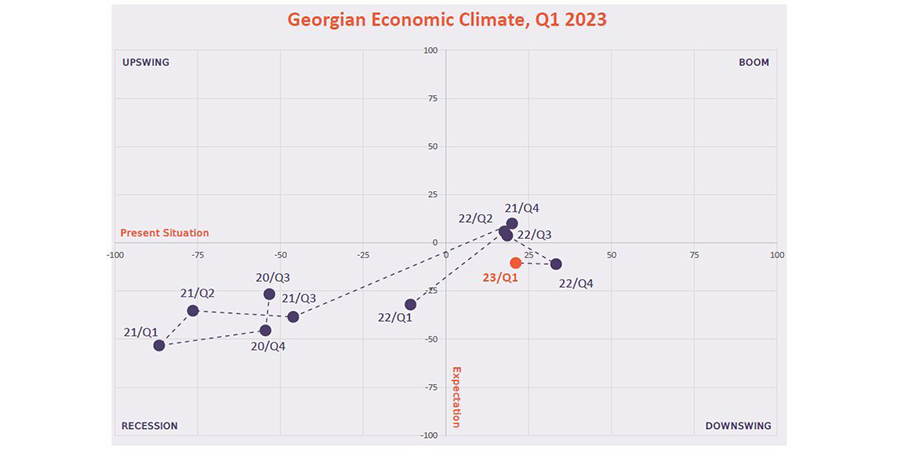

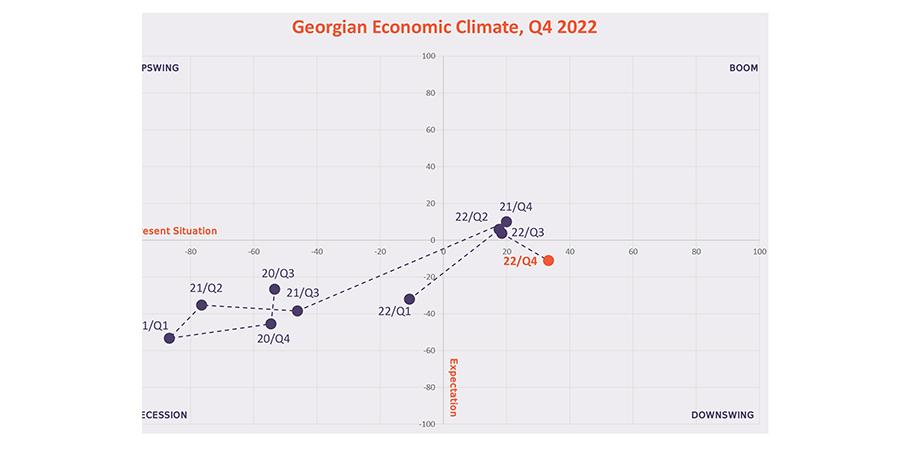

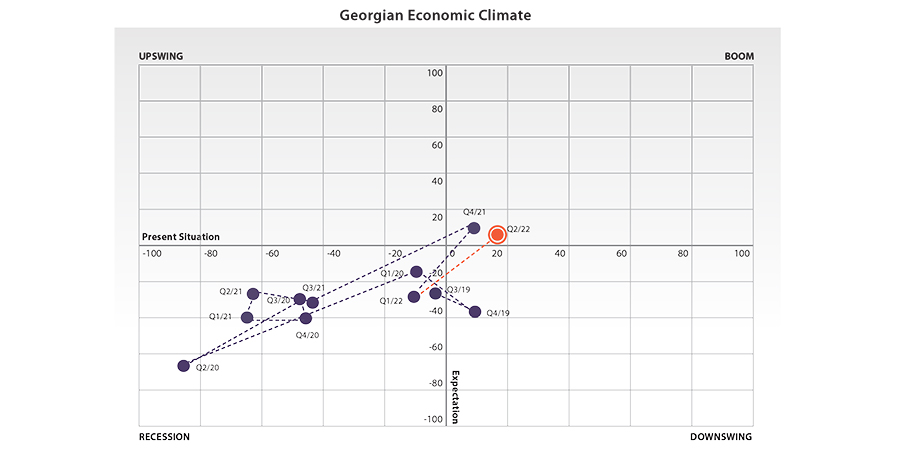

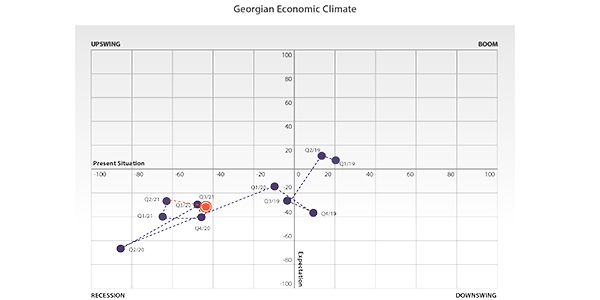

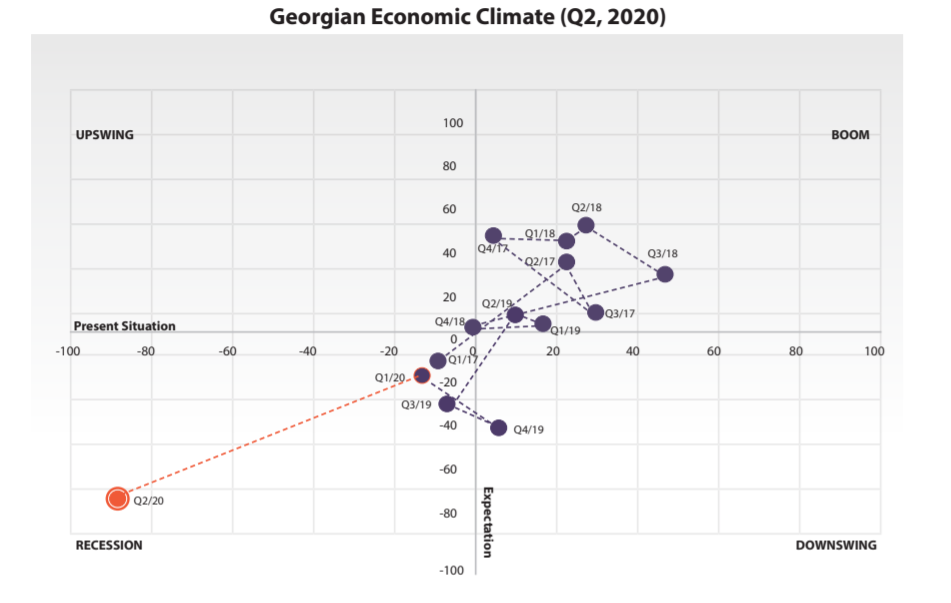

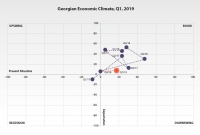

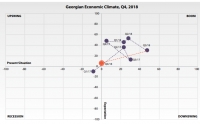

In Q1 2025, surveyed Georgian economists negatively assess Georgia’s present economic situation, and their expectations for the next six months are also negative.

They believe that the political crisis had the most significant impact on the Georgian economy in Q1 2025.

The reduction in foreign assistance, including that from the United States Agency for International Development (USAID), was assessed negatively by 97% of the surveyed economists in terms of its effects on Georgia’s economic and political climate.

Employment Tracker (January, 2025)

2025-02-25 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In January 2025, the number of persons receiving a monthly salary increased by 4% YoY.

In January 2025, the total number of vacancies published on jobs.ge decreased by 9% YoY.

In Q4 of 2024, labor market efficiency slightly increased as the seasonally adjusted unemployment rate declined slightly, while the job openings rate dropped significantly.

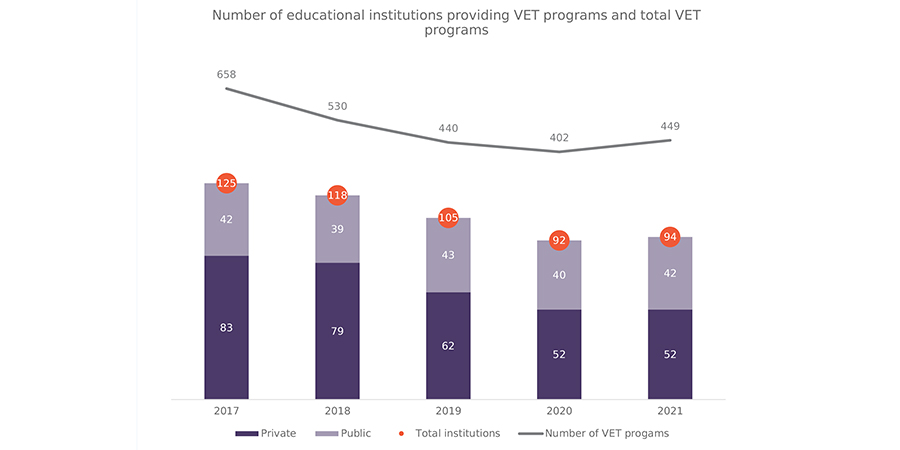

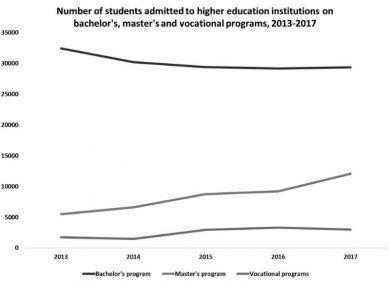

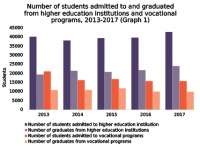

Issue 150: Vocational Education in Georgia

2025-02-10 00:00:00

The latest issue of Economic Outlook and Indicators in Georgia, analyzes Vocational Education in Georgia (2019 – 2023):

State expenditure on VET tripled between 2017 and 2024, with its share in total education spending rising from 3.1% to 4%.

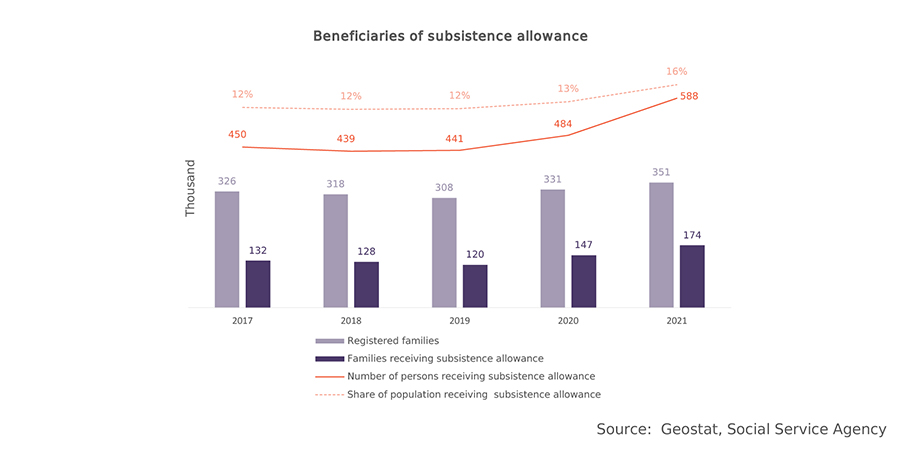

From 2017 to 2023, the number of registered students increased; however, the number of admitted students has not risen correspondingly, leading to a widening gap between registered and admitted students.

The transition from secondary school to VET remains challenging, with 10.6 times more students opting for higher education, albeit the number of registered VET students has grown.

Employment Tracker (December, 2024)

2025-01-22 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In December 2024, the number of people receiving a monthly salary recorded the lowest YoY growth during 2023-2024.

In December 2024, the total number of persons receiving a service fee decreased both YoY and MoM.

In December 2024, the total number of vacancies published on jobs.ge decreased by 20% MoM and 5% YoY.

Please refer to the full publication for more insights.

Georgian Economic Climate (Q4, 2024)

2025-01-16 00:00:00

Our latest Georgian Economic Climate publication offers assessments of various economic developments by Georgian economists.

Assessment of Georgia’s current economic situation was negative, while predictions for Georgia’s economic situation by the end of the next six months were extremely negative. Overall, their outlook was significantly more pessimistic compared to the previous reporting period. Political turmoil and exchange rate fluctuations had the greatest impact on the Georgian economy in Q4 2024. The suspension of EU membership talks was assessed negatively by all surveyed economists in terms of its effects on Georgia’s economy.

Georgia and Kazakhstan

2025-01-14 00:00:00

Georgia and Kazakhstan share strong ties rooted in the historic Silk Road. Today, the countries are connected by the Trans-Caspian route and the Middle Corridor, interest in which has grown in recent years. Since 2022, Georgia has strengthened its relations with Kazakhstan, with new logistics agreements and crucial advances in transport and infrastructure, making Kazakhstan a key trade partner.

The second issue of the Profile of Bilateral Relations offers an in-depth exploration of key topics of the trade relationship between Kazakhstan and Georgia:

Historical Background

Bilateral Trade Between Georgia and Kazakhstan

Identifying Profitable Products for Trade

Transportation Trends

Common Trade Routes Between Georgia and Central Asia

The Middle Corridor

Future Outlook

The full policy paper, “Facilitating Trade with Central Asia: Georgia’s Role as a Transit Corridor“, is available in Georgian.

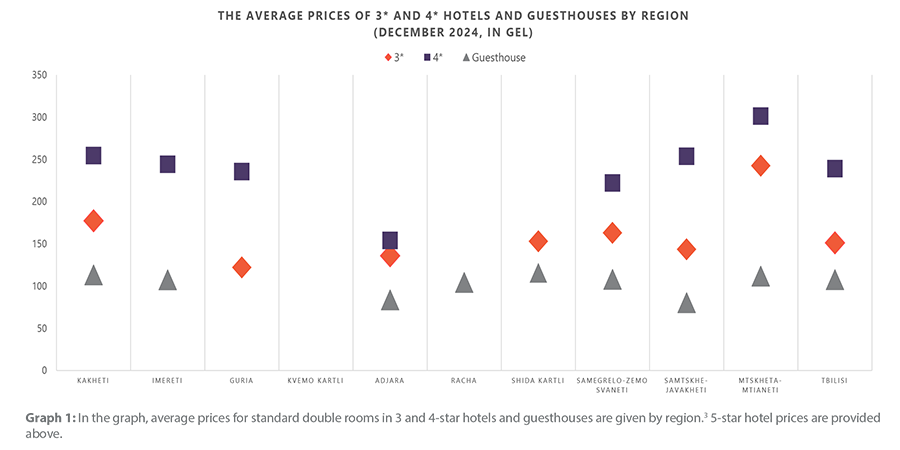

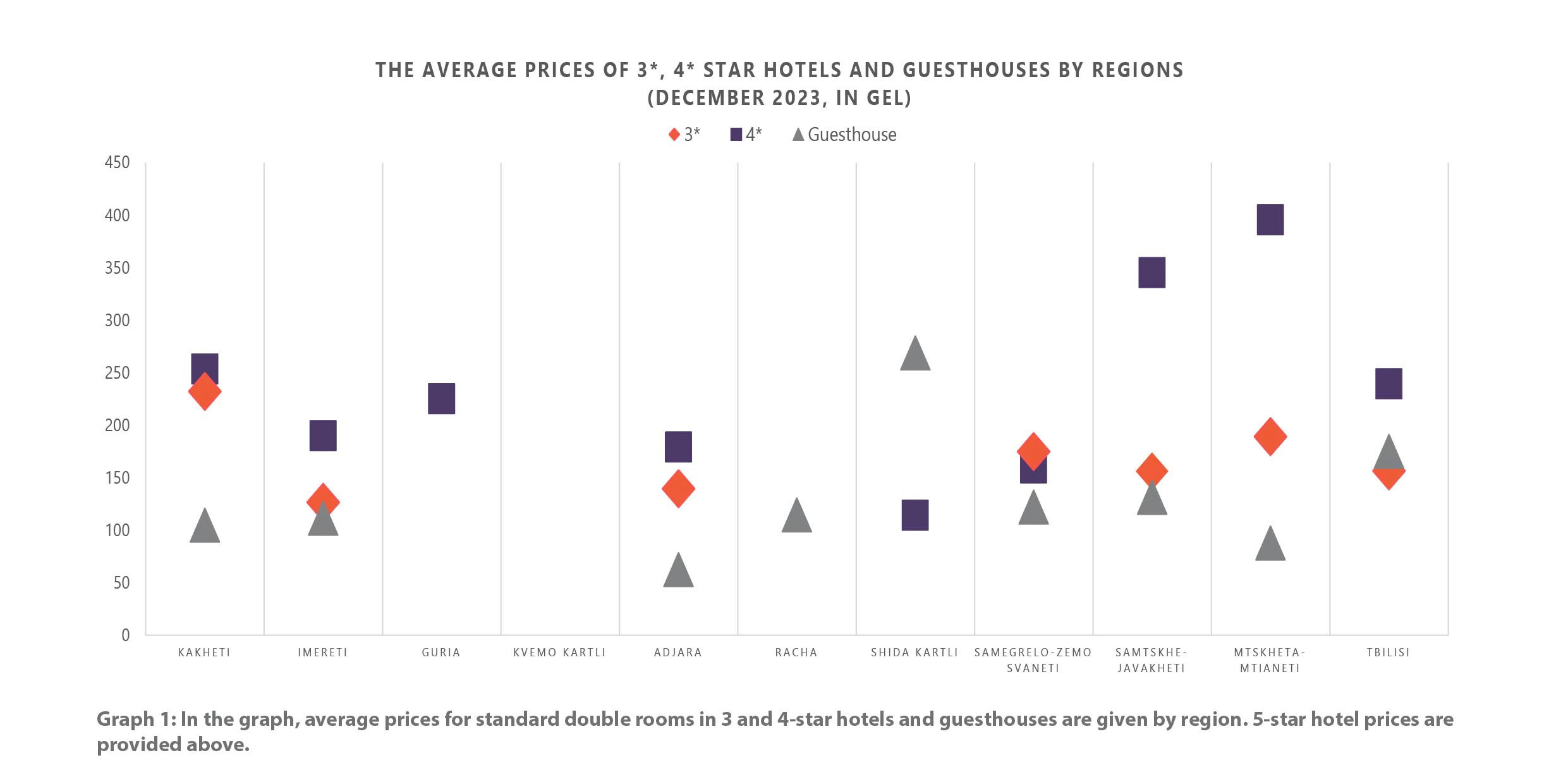

Hotel Price Index (December, 2024)

2024-12-30 00:00:00

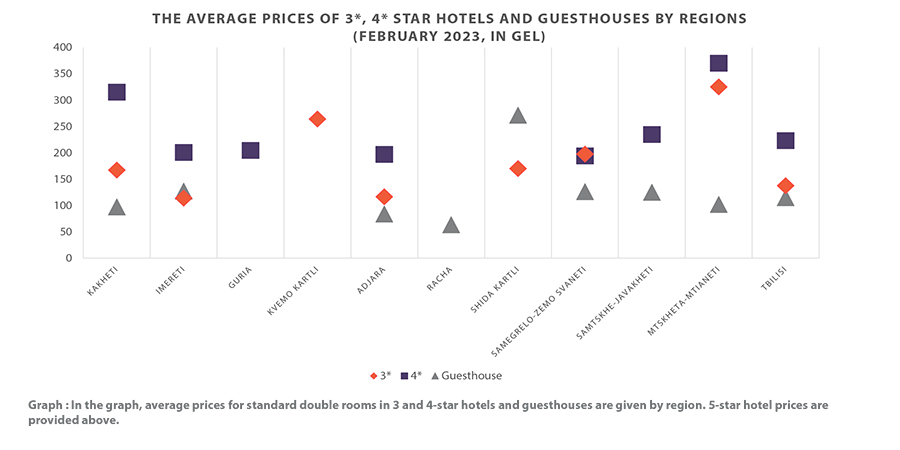

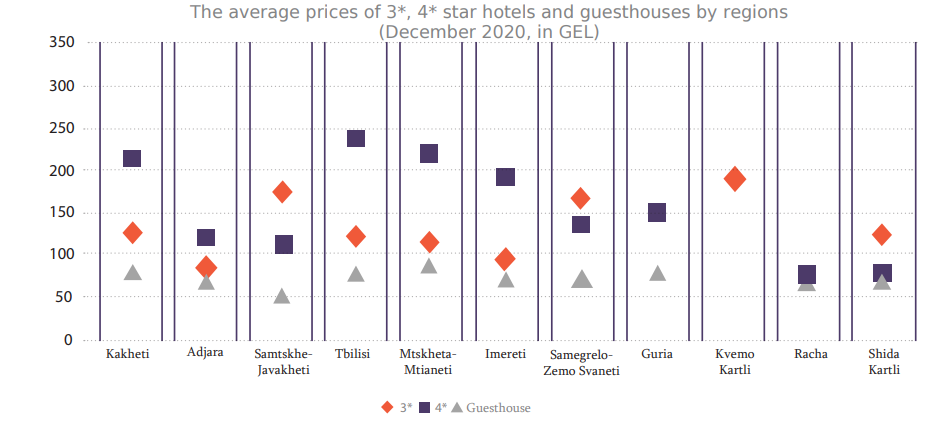

In Georgia, the average cost of a room in a 3-star hotel was 154 GEL per night in December 2024, while the average cost of a room in a 4-star hotel in Georgia was 238 GEL per night and the average cost of a room in a guesthouse was 110 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in December 2024 was 444 GEL per night. In Mtskheta–Mtianeti, the average price was 928 GEL, followed by Tbilisi – 580 GEL, Kakheti – 568 GEL, and Samtskhe-Javakheti – 371 GEL.

Employment Tracker (November, 2024)

2024-12-24 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

November marked the largest YoY decrease in 2024 in the total number of vacancies published on jobs.ge (-9%).

In November 2024, the total number of people receiving a monthly salary reached 1 million for the first time.

In Q3 of 2024, the labor market efficiency decreased as both the seasonally adjusted unemployment rate and the job openings rate increased.

Please refer to the full publication for more insights.

Quarterly Tourism Update (Q3, 2024)

2024-12-18 00:00:00

In Q3 of 2024, Georgia recorded 2.4 million international visits, marking a slight 2% rise YoY, primarily attributed to a 15% decrease in same-day trips, while overnight trips increased by 8%.

In Q3 of 2024, outbound visits declined by 7% YoY, possibly due to rising travel costs, particularly in Türkiye, the top destination for Georgian outbound visitors, where inflation led to a 68% YoY increase in hospitality costs.

Over two years, 125,000 people attended performances as part of the “Starring Georgia” series, while income generated from ticket sales amounted to GEL 21.4 million, with tourists contributing 16%.

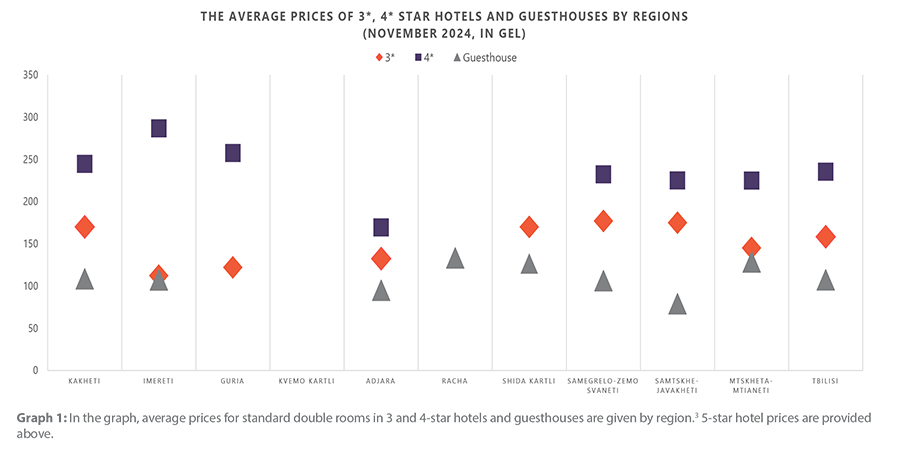

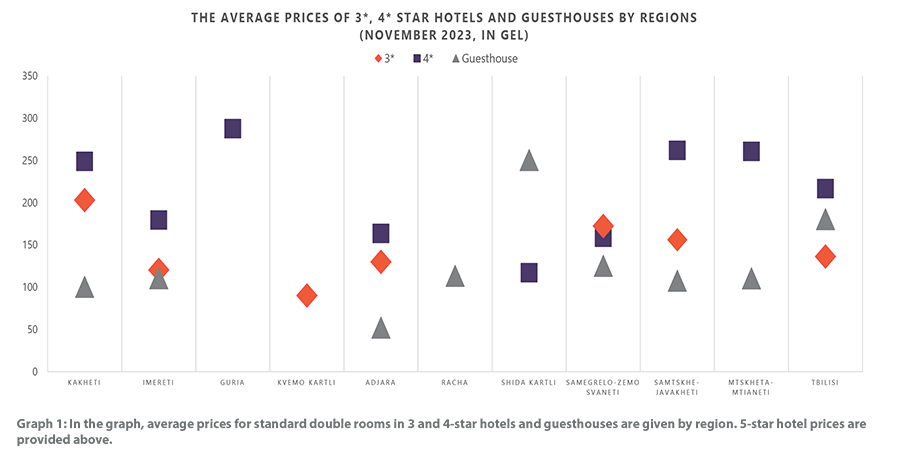

Hotel Price Index (November, 2024)

2024-12-05 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 153 GEL per night in November 2024, while the average cost of a room in a 4-star hotel in Georgia was 232 GEL per night and the average cost of a room in a guesthouse was 111 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in November 2024 was 443 GEL per night. In Tbilisi, the average price was 612 GEL, followed by Kakheti – 548 GEL, Guria – 502 GEL, and Mtskheta–Mtianeti – 372 GEL.

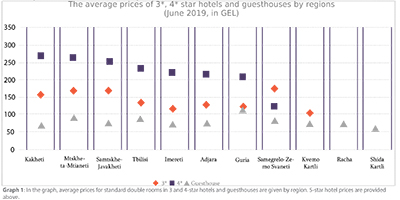

Hospitality Sector in Georgia

2024-11-26 00:00:00

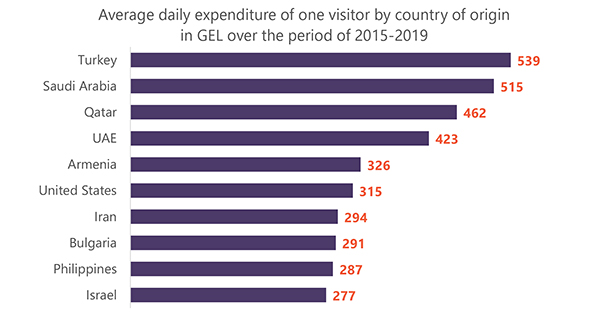

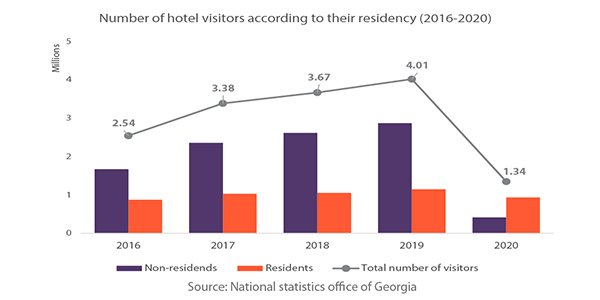

Georgia's hospitality industry benefits from country’s rich cultural and natural attractions. To support the growing interest in these offerings, Georgia has 3,198 registered accommodation providers, though most are smaller-capacity family hotels and guesthouses.

Since 2020, 238 new hotels have opened, and another 324 are planned by 2027, which will increase bed capacity by 130%. While Tbilisi and Adjara see the most growth, rural areas lag behind.

Key challenges include weak long-term planning, high operating costs for smaller businesses, and limited market diversification. For the sector to grow sustainably, the focus must shift to improving infrastructure, diversifying markets, and attracting high-value tourists.

Employment Tracker (October, 2024)

2024-11-21 00:00:00

The latest issue of Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In October 2024, the number of people receiving a monthly salary increased by 3.2% YoY.

The share of individuals earning up to 600 GEL continues to decrease, though they still represent a notable portion (15%) of total salary recipients.

Over the past six months, the Administration and Management sector, previously one of the fastest-growing, has experienced a decline in the number of vacancies.

Please refer to the full publication for more insights.

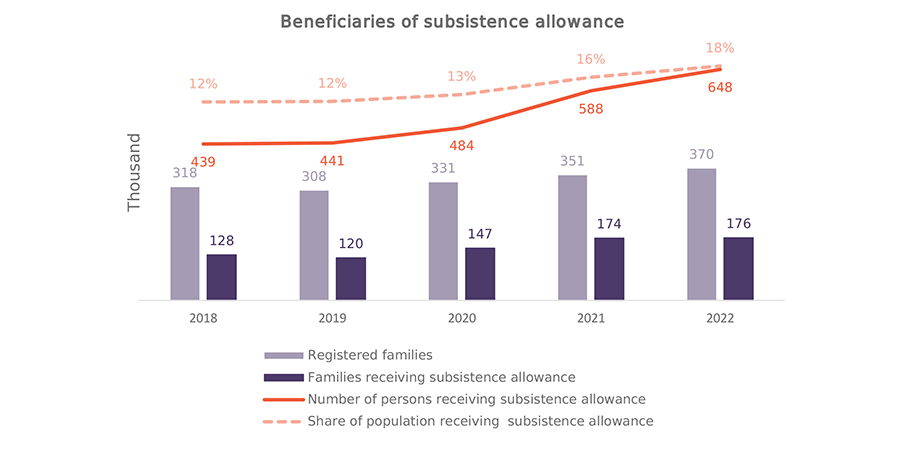

Issue 149: Household Income and Poverty in Georgia (2019 – 2023)

2024-11-15 00:00:00

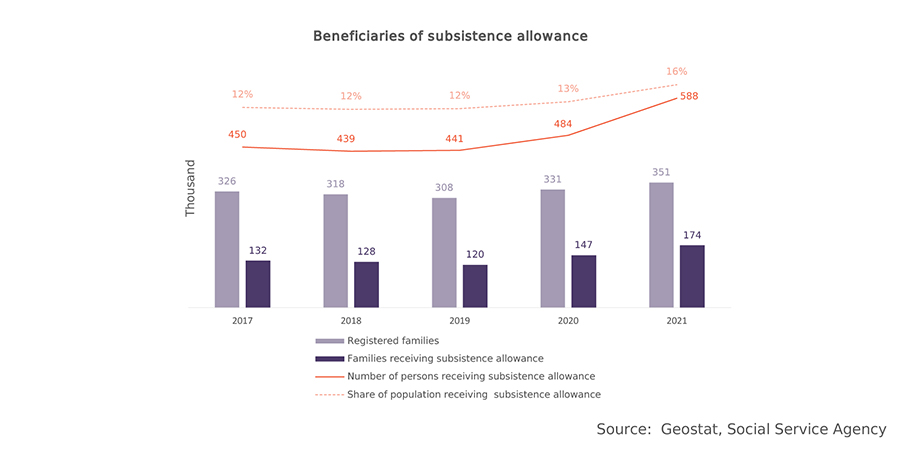

Our latest publication analyzes Household Income and Poverty in Georgia (2019 – 2023):

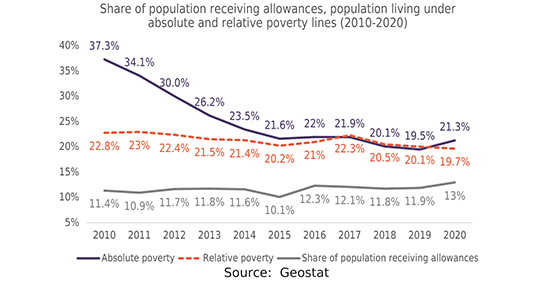

From 2019 to 2023, Georgia’s nominal median household income grew at a compound annual growth rate (CAGR) of 11%, while real median household income, adjusted for inflation, increased at a CAGR of 4% annually.

During this period, social transfers accounted for an average of 58% of the total income for the poorest 20% of households, highlighting their strong reliance on government assistance.

Between 2020 and 2023, absolute poverty significantly decreased from 21.3% to 11.8%, while the relative poverty rate remained relatively stable, dropping by just 0.3 percentage points to 19.8%.

The share of households reporting themselves as “poor” or “extremely poor” decreased slightly from 39.7% to 35.4% over the analyzed period, suggesting a persistent gap between subjective and objective measures of poverty.

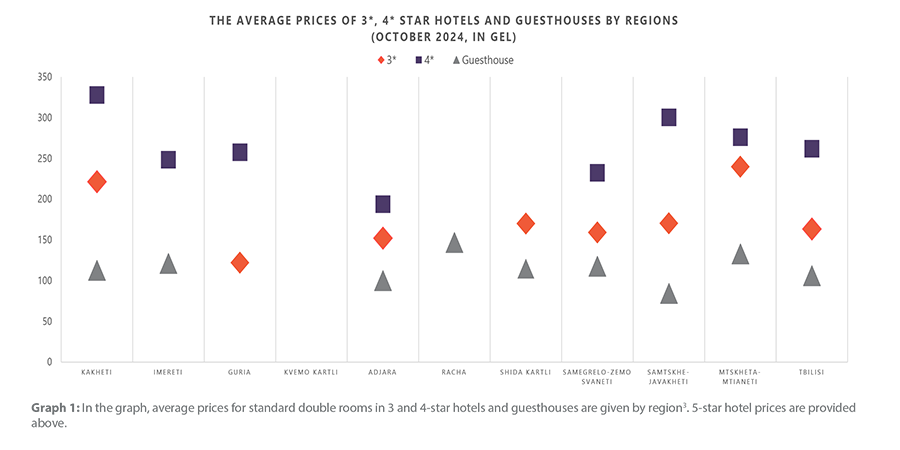

Hotel Price Index (October, 2024)

2024-11-07 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 168 GEL per night in October 2024, while the average cost of a room in a 4-star hotel in Georgia was 261 GEL per night and the average cost of a room in a guesthouse was 115 GEL per night.

Employment Tracker (September, 2024)

2024-10-24 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In September 2024, 149 thousand persons received a monthly salary of up to 600 GEL.

Over the past 6 months (from April 2024 to September 2024), the IT/Programming sector experienced a decline in the number of vacancies posted on jobs.ge compared to the same period of 2023 (-11.6%).

From April 2024 to September 2024, the average YoY growth of vacancies published on jobs.ge sped up.

Please refer to the full publication for more insights.

Georgia and the United States of America

2024-10-22 00:00:00

The U.S. has been a key economic partner for Georgia since regaining its independence in the early 1990s, providing significant support in the form of foreign assistance, foreign direct investment (FDI), and remittances.

The first issue of the Profile of Bilateral Relations offers an in-depth exploration of key topics of the relationship between the United States and Georgia:

Historical Background

Bilateral Trade

Foreign Direct Investment (FDI)

U.S. Multinational Enterprises (MNEs) in Georgia

U.S. Foreign Assistance

Migration

Remittances

Foreign Exchange Flows

Future Outlook

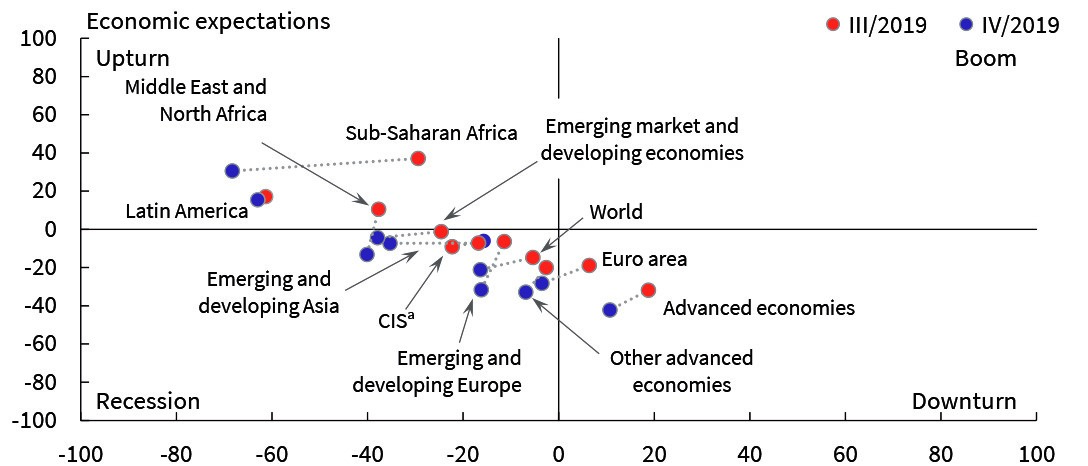

Issue 7: Macro Overview

2024-10-17 00:00:00

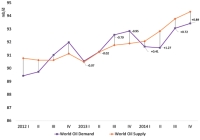

From January to August 2024, the Georgian economy demonstrated robust performance, with an average real GDP growth rate of 9.6%. Education and transportation and storage were the key contributors to growth in the first 6M of 2024, with contributions of 14.6% and 13.3%, respectively.

Issue seven of the Macro Overview thoroughly explores different aspects of the economy in Georgia and beyond, including:

Economic Growth;

Economic and Business Climate;

Key Macroeconomic Indicators;

Labor Market;

External Sector;

Global Economic Trends.

Hotel Price Index (September, 2024)

2024-10-11 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 178 GEL per night in September 2024, while the average cost of a room in a 4-star hotel in Georgia was 291 GEL per night and the average cost of a room in a guesthouse was 110 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in September 2024 was 547 GEL per night. In Tbilisi, the average price was 721 GEL, followed by Guria – 661 GEL, Kakheti – 649 GEL, and Adjara – 476 GEL.

BAG Index (Q3, 2024)

2024-10-09 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

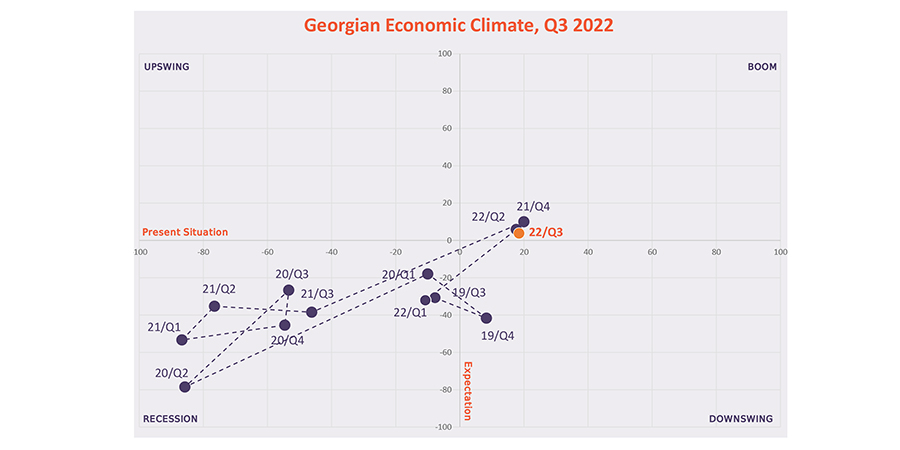

Georgian Economic Climate (Q3, 2024)

2024-10-03 00:00:00

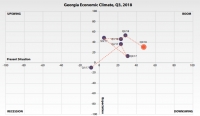

Our latest Georgian Economic Climate publication offers assessments of various economic developments by Georgian economists.

Assessment of Georgia’s present economic situation was slightly positive, while predictions for Georgia’s economic situation by the end of the next six months were negative. Overall, their outlook was significantly more optimistic compared to the previous reporting period.

Political instability and labor shortage had the greatest impact on the Georgian economy in Q3 2024.

The pause in U.S. assistance “that directly benefits the Government of Georgia” was assessed very negatively in terms of its effects on Georgia’s economy.

Please refer to the full publication for more insights.

BAG Index (Q2, 2024)

2024-10-01 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

Employment Tracker (August, 2024)

2024-09-25 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In August 2024, 148 thousand persons received a monthly salary up to 600 GEL.

Over the past 6 months (from March 2024 to August 2024), the IT/Programming sector experienced a decline in the number of vacancies posted on jobs.ge compared to the same period of 2023.

In Q2 of 2024, as in the previous quarter, the labor market efficiency is returning to its pre-pandemic levels. However, further observation is needed to draw final conclusions.

Please refer to the full publication for more insights.

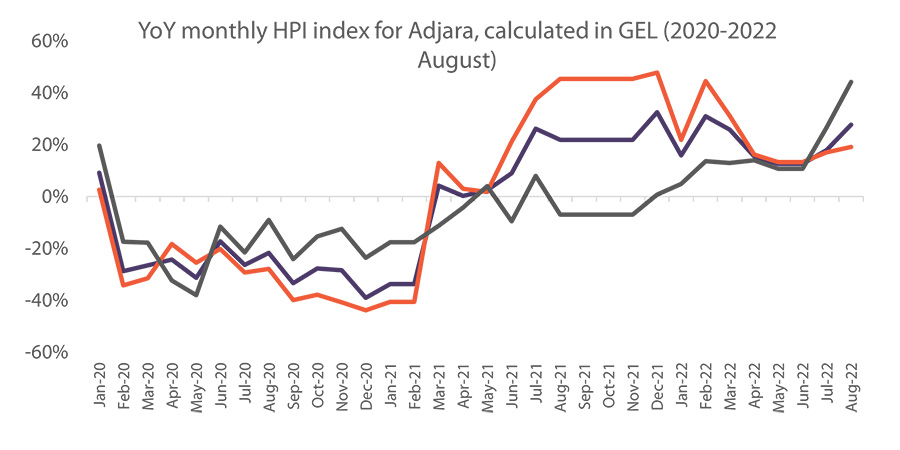

Quarterly Tourism Update (Q2, 2024)

2024-09-19 00:00:00

In Q2 of 2024, unlike the previous quarter, overnight visits did not fully recover to 2019 levels. Hotel representatives attributed this lag in recovery to civil protests and political instability in May over the Georgian government’s passing of the “Law on Transparency of Foreign Influence.”

The biggest increase in visits was recorded from China (127%), which is likely due at least in part to the number of direct flights between China and Georgia doubling.

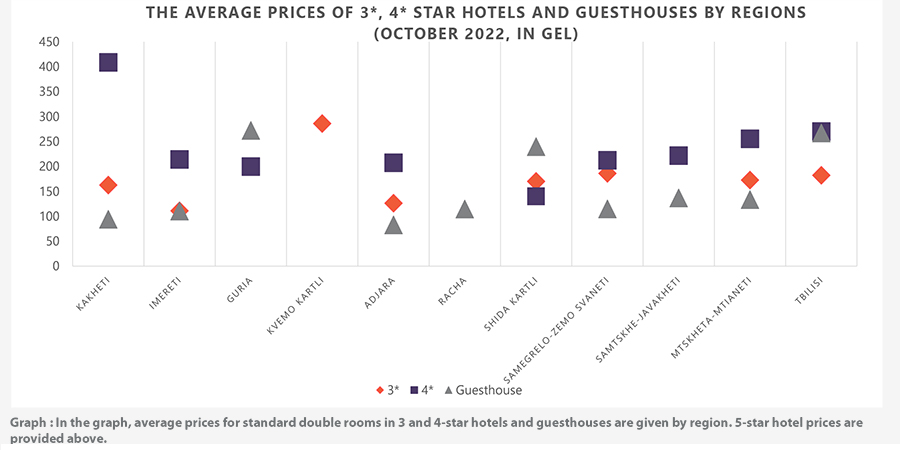

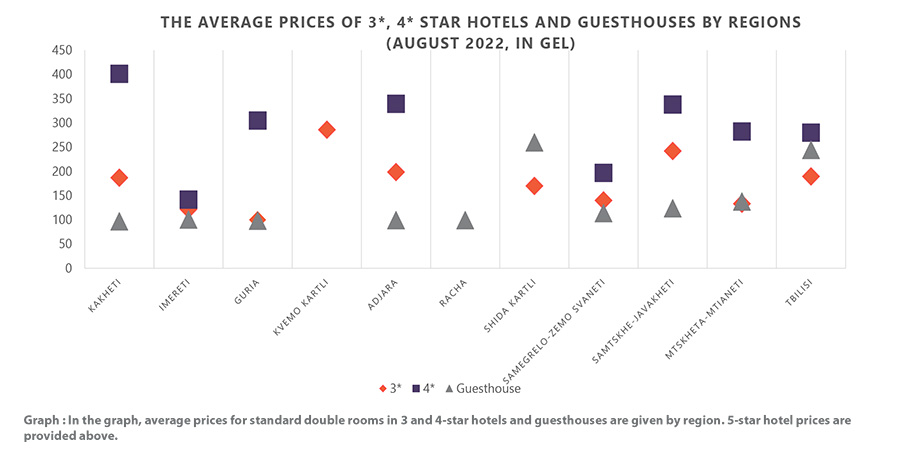

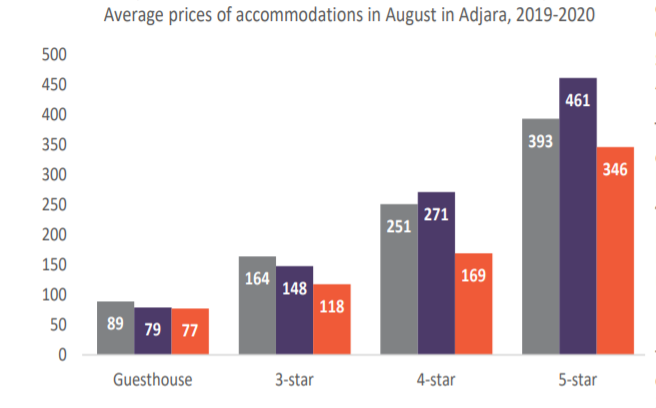

From April to August 2024, average hotel prices in Adjara increased for 3-star hotels (5% YoY), 5-star hotels (10% YoY), and guesthouses (13% YoY), while the average 4-star hotel price declined by 15%.

Hotel Price Index (August, 2024)

2024-09-04 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 184 GEL per night in August 2024, while the average cost of a room in a 4-star hotel in Georgia was 272 GEL per night and the average cost of a room in a guesthouse was 114 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in August 2024 was 586 GEL per night. In Guria, the average price was 1012 GEL, followed by Tbilisi – 687 GEL, Kakheti – 686 GEL, and Adjara – 575 GEL.

Employment Tracker (July, 2024)

2024-08-22 00:00:00

Our latest monthly publication, Employment Tracker, offers insights into recent developments in Georgia’s labor market.

In July 2024, the share of people receiving a lower monthly salary (up to 600 GEL) decreased (-2.9%), while the share of people receiving the highest salary range (9,600 GEL and more) increased (+0.6%).

In July 2024, the total number of vacancies published on jobs.ge was the highest since 2022.

Over the past 6 months (from February 2024 to July 2024), the fastest growing number of vacancies category was logistics, transport and distribution.

Please refer to the full publication for more insights.

Hotel Price Index (July, 2024)

2024-08-06 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 178 GEL per night in July 2024, while the average cost of a room in a 4-star hotel in Georgia was 272 GEL per night and the average cost of a room in a guesthouse was 114 GEL per night.

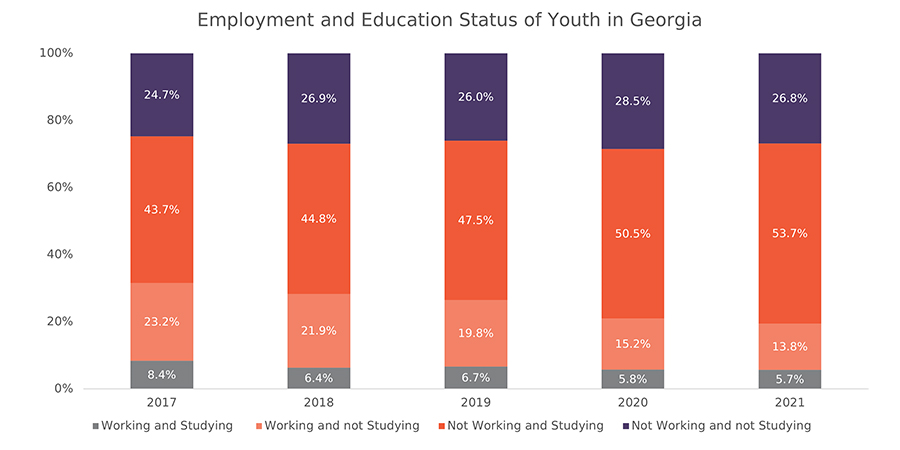

Issue 148: Youth Employment in Georgia

2024-08-01 00:00:00

Our latest publication examines youth employment in Georgia from 2020 to 2023.

The successful participation of youth (those aged 15-24) in Georgia’s labor market is vital for the country’s socioeconomic development. It promotes social integration, reduces poverty, and boosts economic productivity.

During 2020-2023, the contribution of youth to the Georgian labor market declined, even though during this time the proportion of youth among the total population aged 15 and older remained stable. Decreasing participation of youth in the labor market is driven by both emigration and extended education periods.

In 2023, approximately one out of every five young persons in Georgia neither worked nor studied, while only 7% of them managed to work and study simultaneously.

Please refer to the full publication for more insights.

Employment Tracker (June, 2024)

2024-07-24 00:00:00

Our latest Employment Tracker publication offers insights into recent developments in Georgia’s labor market.

In June 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+3.6 pp).

In June 2024, the number of vacancies published on jobs.ge did not change compared to June 2023.

Over the past 6 months (from January 2024 to June 2024), the fastest growing number of vacancies category was administration and management.

Please refer to the full publication for more insights.

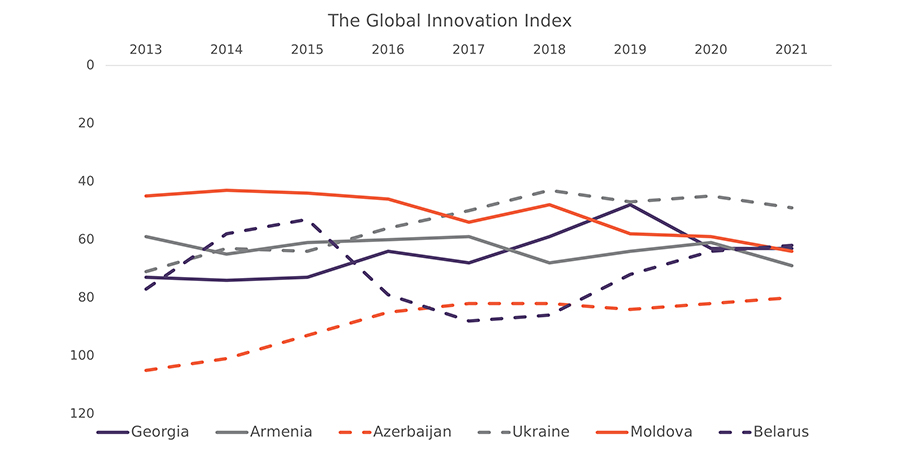

Innovation ecosystems in Black Sea Countries

2024-07-23 00:00:00

Amid rapid technological advancements and the widespread development of AI (specifically, the democratization of generative AI), coupled with the fraught geopolitical situation in the region, largely stemming from Russia’s ongoing war on Ukraine, it is imperative to understand the nuances of the innovation ecosystems of Black Sea countries.

Quarterly Tourism Update (Q1, 2024)

2024-07-10 00:00:00

Our latest Quarterly Tourism Update offers insight into Georgia’s tourism indicators in Q1 of 2024.

In Q1 of 2024, international visits to Georgia increased by 25%, compared to Q1 of 2023. For such visits, Türkiye was the leading country of origin, closely followed by Russia.

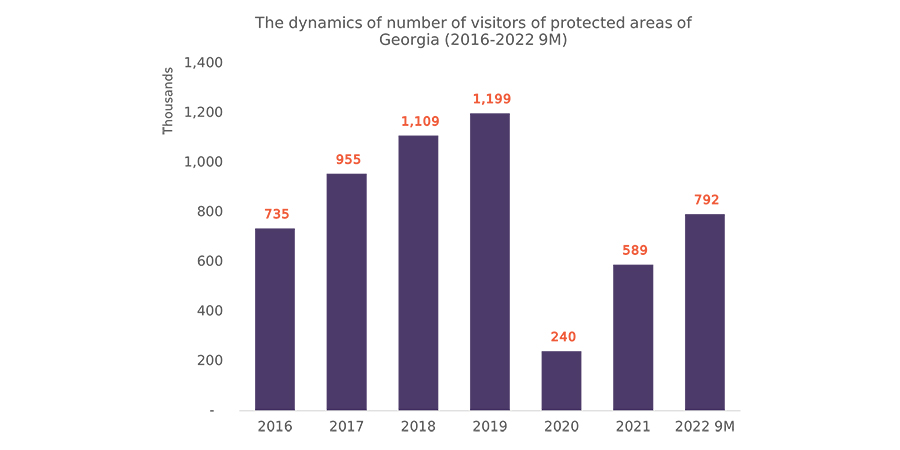

In Q1 of 2024, visits to Georgia’s protected areas did not recover to pre-pandemic levels for the corresponding period.

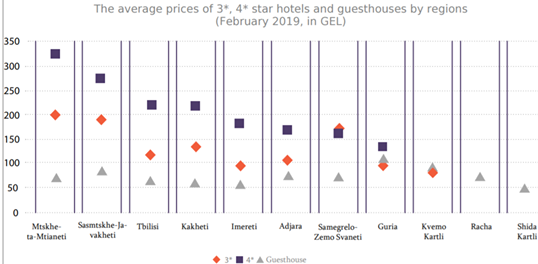

In Q1 of 2024, average hotel prices in Georgia generally increased compared to the same period in 2023.

Hotel Price Index (June, 2024)

2024-07-08 00:00:00

In Georgia, the average cost of a room1 in a 3-star hotel was 183 GEL per night in June 2024, while the average cost of a room in a 4-star hotel in Georgia was 275 GEL per night and the average cost of a room in a guesthouse2 was 126 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in June 2024 was 518 GEL per night. In Guria, the average price was 757 GEL, followed by Kakheti – 641 GEL, Tbilisi – 597 GEL, and Adjara – 524 GEL.

Georgian Economic Climate (Q2, 2024)

2024-07-04 00:00:00

The latest Georgian Economic Climate (Q2, 2024) publication offers assessments of various economic developments by Georgian economists.

Assessment of Georgia’s present economic situation was slightly negative, while predictions for Georgia’s economic situation by the end of the next six months were also negative.

Political instability and exchange rate fluctuations had the greatest impact on the Georgian economy in Q2 2024.

The bill on “transparency of foreign influence” is expected to have a negative impact on the EU accession process, FDI inflows, and currency depreciation.

Employment Tracker (May, 2024)

2024-06-27 00:00:00

Our latest Employment Tracker publication offers insights into recent developments in Georgia’s labor market.

In May 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+5.6 pp).

In May 2024, the number of vacancies published on jobs.ge decreased by 3% compared to May 2023.

The labor market efficiency is returning to its pre-pandemic levels. However, further observation is needed to draw final conclusions.

Please refer to the full publication for more insights.

Ukraine In International Rankings

2024-06-19 00:00:00

This publication compares the position of Ukraine in relation to two fellow EU candidate countries, namely Georgia and Moldova, to understand where it stands on European integration. Specifically, it evaluates the performance of all three nations alongside that of EU member states across several key indices and rankings.

A promising trend is evident in Ukraine's Control of Corruption indicator, showing a steady increase from 2019 to 2022. Fighting corruption is a key demand of the Ukrainian people and a crucial prerequisite for EU accession.

According to the European Commission, despite Russia’s full-scale invasion in February 2022 and subsequent war, Ukraine has persisted in advancing democratic and rule of law reforms. Relatedly, in December 2023, EU leaders initiated accession negotiations with Ukraine.

Hotel Price Index (May, 2024)

2024-06-06 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 157 GEL per night in May 2024, while the average cost of a room in a 4-star hotel in Georgia was 252 GEL per night and the average cost of a room in a guesthouse was 118 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in May 2024 was 425 GEL per night. In Guria, the average price was 659 GEL, followed by Tbilisi – 635 GEL, Kakheti – 478 GEL, and Adjara – 344 GEL.

Issue 147: Georgia in International Rankings

2024-06-03 00:00:00

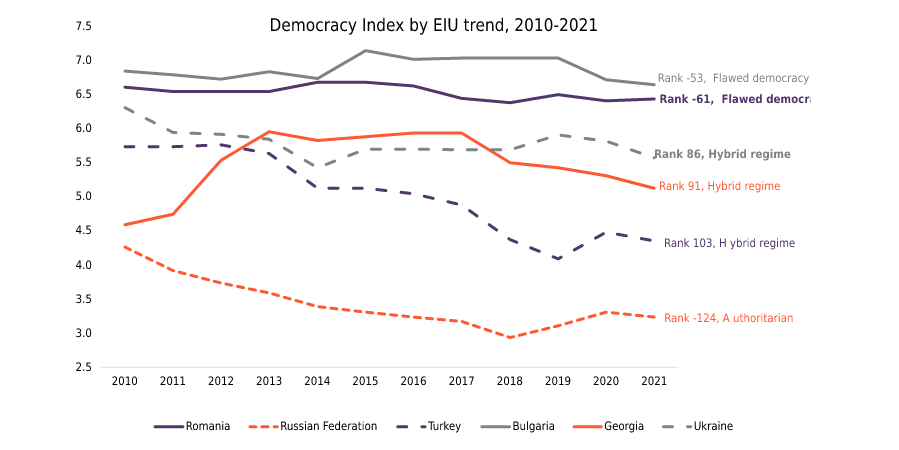

This publication analyzes where Georgia stands in comparison to Moldova and Ukraine, two other countries with candidate status for EU membership, and evaluates how these three countries are performing relative to EU member states across several key indices and rankings to gain a comprehensive understanding of Georgia’s position regarding European integration.

The most significant gap between Georgia and the EU average was identified in the area of Democracy, according to the analysis. Today, this concern is heightened as democracy in Georgia is considered to be under threat as the Parliament of Georgia has passed a law on the transparency of foreign influence.

Employment Tracker (April, 2024)

2024-05-24 00:00:00

In April 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+5.2 pp).

In April 2024, the number of vacancies published on jobs.ge increased by 22% compared to April 2023.

Over the past 6 months (from November 2023 to April 2024), the fastest growing number of vacancies category was administration and management.

Re-assessment of the Effectiveness of Sanctions Against Russia

2024-05-22 00:00:00

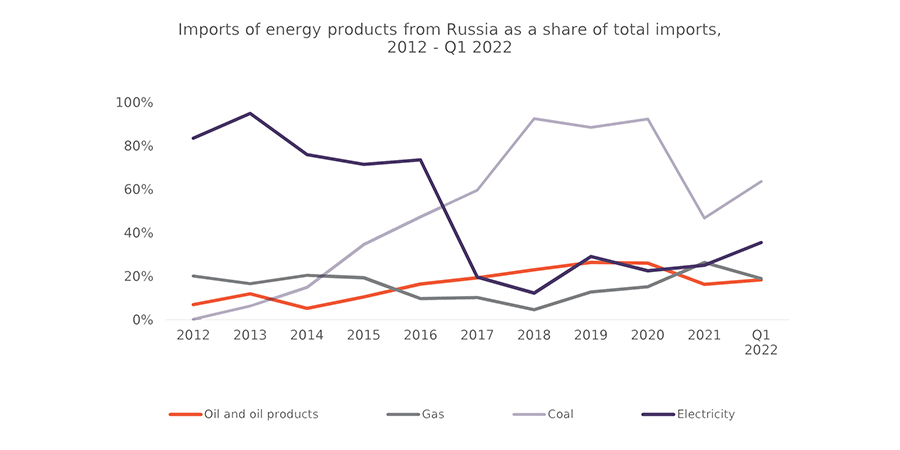

More than two years have now passed since Russia’s full-scale invasion of Ukraine on 24 February 2022. During this period, an unprecedentedly broad package of sanctions has been imposed against Russia, with the quantity of measures and the targeted sectors, entities, and individuals constantly expanding. This bulletin, which is a follow up to an earlier issue published in 2022, provides a re-assessment of the effectiveness of the most important sanctions to have been imposed on Russia since its invasion of Ukraine on 24 February 2022.

Hotel Price Index (April, 2024)

2024-05-15 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 154 GEL per night in April 2024, while the average cost of a room in a 4-star hotel in Georgia was 244 GEL per night and the average cost of a room in a guesthouse was 121 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in April 2024 was 431 GEL per night. In Tbilisi, the average price was 554 GEL, followed by Kakheti – 466 GEL, Adjara – 428 GEL, and Samtskhe-Javakheti – 290 GEL.

Employment Tracker (March, 2024)

2024-04-26 00:00:00

Our latest Employment Tracker publication offers insights into recent developments in Georgia’s labor market.

In March 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+7 pp).

In March 2024, the number of vacancies published on jobs.ge increased by 2% compared to March 2023.

Over the past 6 months (from October 2023 to March 2024), the fastest growing number of vacancies category was administration and management.

Hotel Price Index (March, 2024)

2024-04-19 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 153 GEL per night in March 2024, while the average cost of a room in a 4-star hotel in Georgia was 247 GEL per night and the average cost of a room in a guesthouse was 133 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in March 2024 was 449 GEL per night. In Tbilisi, the average price was 611 GEL, followed by Guria – 550 GEL, Kakheti – 545 GEL, and Adjara – 417 GEL.

Georgian Economic Climate (Q1, 2024)

2024-04-11 00:00:00

Our latest Georgian Economic Climate publication offers assessments of various economic developments by Georgian economists.

Georgia’s present economic situation was assessed positively. Predictions for Georgia’s economic situation for the next six months were also slightly positive.

Export volumes are forecasted to decline, and import volumes are expected to increase over the next six months compared to 2023.

EU candidacy and labor shortage has the greatest impact on the Georgian economy. Additionally, employment and the labor market is the most challenging area when it comes to Georgia’s alignment with the EU standards.

BAG Index (Q1, 2024)

2024-04-04 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research Center, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. BAG and PMC Research Center publish the BAG Index on a quarterly basis from Q4 2019.

For the previous reports of the BAG Index, please visit the following link: https://bag.ge/ge/bag-index

Quarterly Tourism Update (Tourism Indicators in 2023)

2024-04-02 00:00:00

Our latest Quarterly Tourism Update offers insight into Georgia’s tourism indicators in 2023.

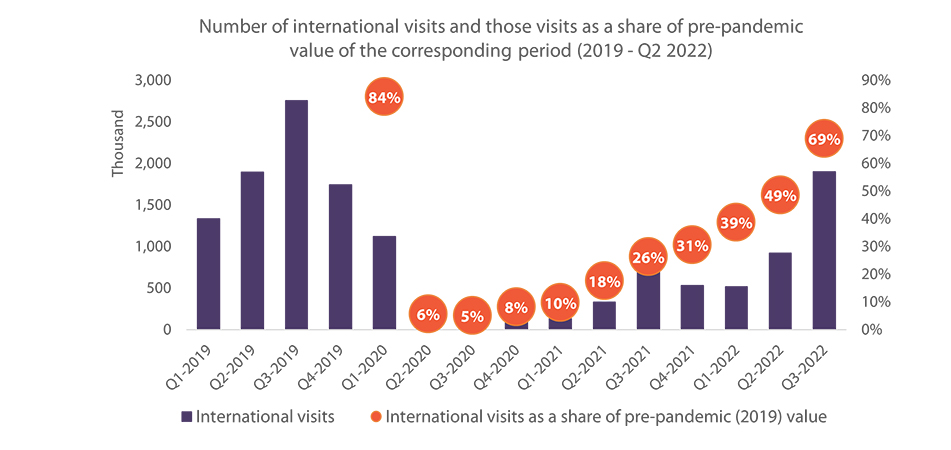

In 2023, international visits to Georgia increased significantly (by 31%) compared to 2022, but still did not recover to pre-pandemic levels, reaching only 80% of the 2019 total.

In 2023, international visits to Georgia's mountain resorts did not recover to pre-pandemic levels.

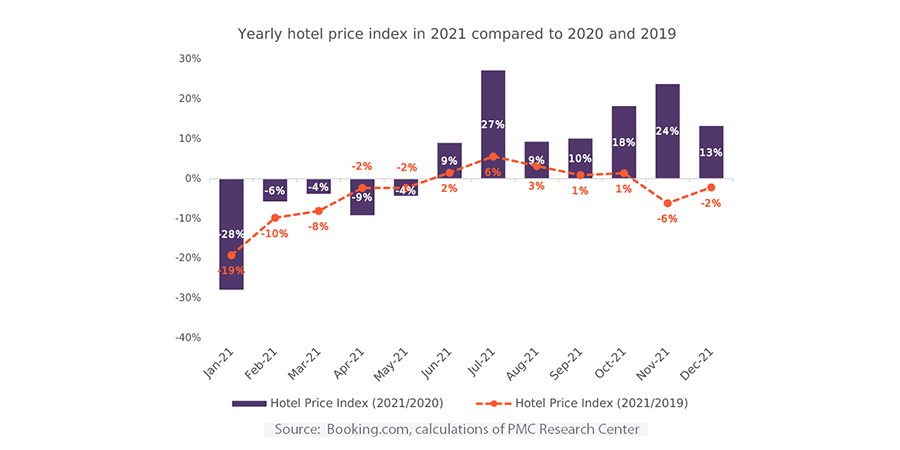

In 2023, average hotel prices in Georgia experienced a general decrease compared to 2022.

Employment Tracker (February, 2024)

2024-03-27 00:00:00

Employment Tracker publication offers insights into recent developments in Georgia’s labor market.

In February 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+1pp).

In February 2024, the number of vacancies published on jobs.ge increased by 13% compared to February 2023.

Over the past 6 months (from September 2023 to February 2024), the fastest growing number of vacancies category was administration and management.

Transportation and Logistics Sector in Georgia

2024-03-20 00:00:00

Transportation and logistics sector in Georgia is a vital pillar of the economy, facilitating domestic and international trade. Notably, Georgia's strategic location along the Middle Corridor enhances its significance as a key transit hub connecting Europe and Asia.

In 2023, Georgia's transportation and storage sector experienced moderate growth, with its contribution to GDP increasing by 5.1% despite facing challenges like disruptions in trade with Russia. Although the sector’s share of total gross output declined slightly (-0.8 percentage points, YoY), it remains vital, contributing 6.5% to the national economy's overall output.

Looking ahead, Georgia's transportation and logistics sector is expecting further growth and development. Despite recent challenges, the sector's strategic location along the Middle Corridor presents promising opportunities for expansion. With ongoing efforts to enhance infrastructure and connectivity, Georgia is well-positioned to strengthen its role as a key transit hub between Europe and Asia.

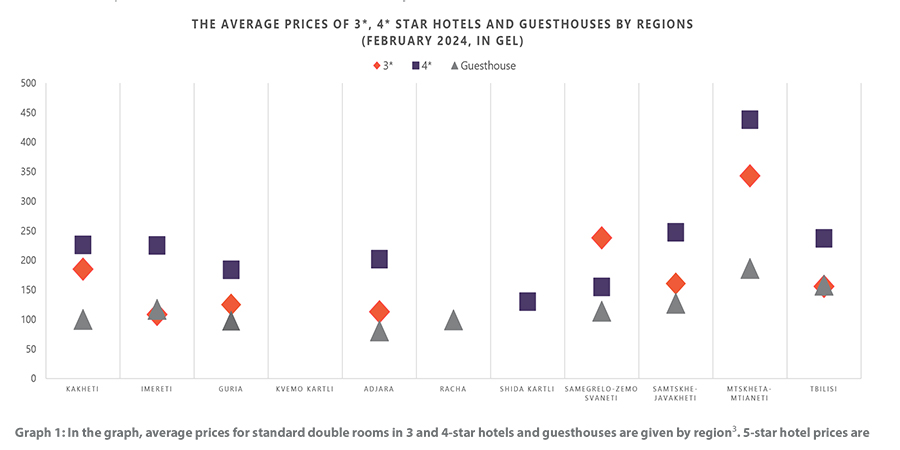

Hotel Price Index (February, 2024)

2024-03-14 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 158 GEL per night in February 2024, while the average cost of a room in a 4-star hotel in Georgia was 261 GEL per night and the average cost of a room in a guesthouse was 128 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in February 2024 was 416 GEL per night. In Tbilisi, the average price was 596 GEL, followed by Kakheti – 551 GEL, Guria – 486 GEL, and Adjara – 304 GEL.

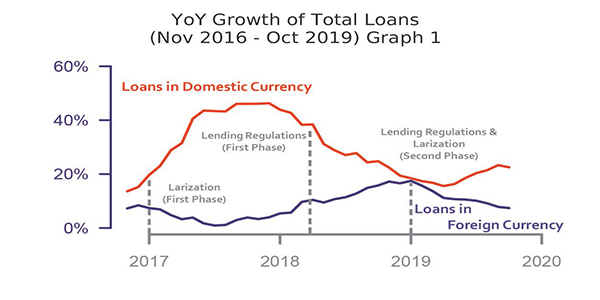

Issue 6: Macro Overview

2024-02-28 00:00:00

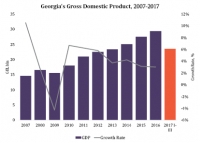

Georgia's economic growth remained robust (7.5%) in 2023, albeit at a slower pace than the previous two years.

In 2023, several factors presented positive and adverse economic developments - examined within the report in detail, along with the outlook for 2024.

Issue 6 of the Macro Overview thoroughly explores different aspects of the economy in Georgia and beyond, including:

Economic Growth;

Economic and Business Climate;

Key Macroeconomic Indicators;

Labor Market;

External Sector;

Global Economic Trends.

Employment Tracker (January, 2024)

2024-02-22 00:00:00

The latest Employment Tracker publication offers insights into recent developments in Georgia’s labor market.

Following a temporary year-over-year decrease of vacancies in December 2023, in the beginning of 2024, the trend of an increasing number of vacancies resumed.

In January 2024, the share of people receiving a monthly salary of 2400 GEL or more continued to increase (+8pp).

Over the past 6 months (from August 2023 to January 2024), the fastest growing number of vacancies category was administration and management.

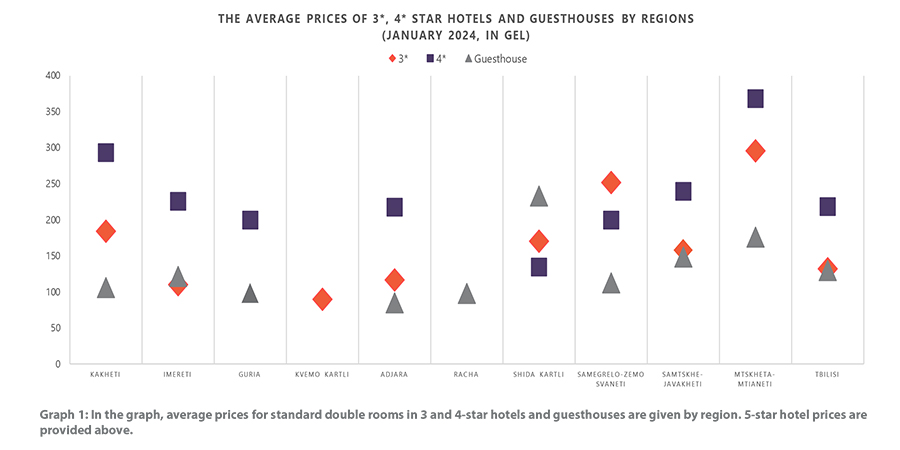

Hotel Price Index (January, 2024)

2024-02-15 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 143 GEL per night in January 2024, while the average cost of a room in a 4-star hotel in Georgia was 248 GEL per night and the average cost of a room in a guesthouse was 125 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in January 2024 was 418 GEL per night. In Kakheti, the average price was 639 GEL, followed by Tbilisi – 498 GEL, Guria – 538 GEL, and Adjara – 328 GEL.

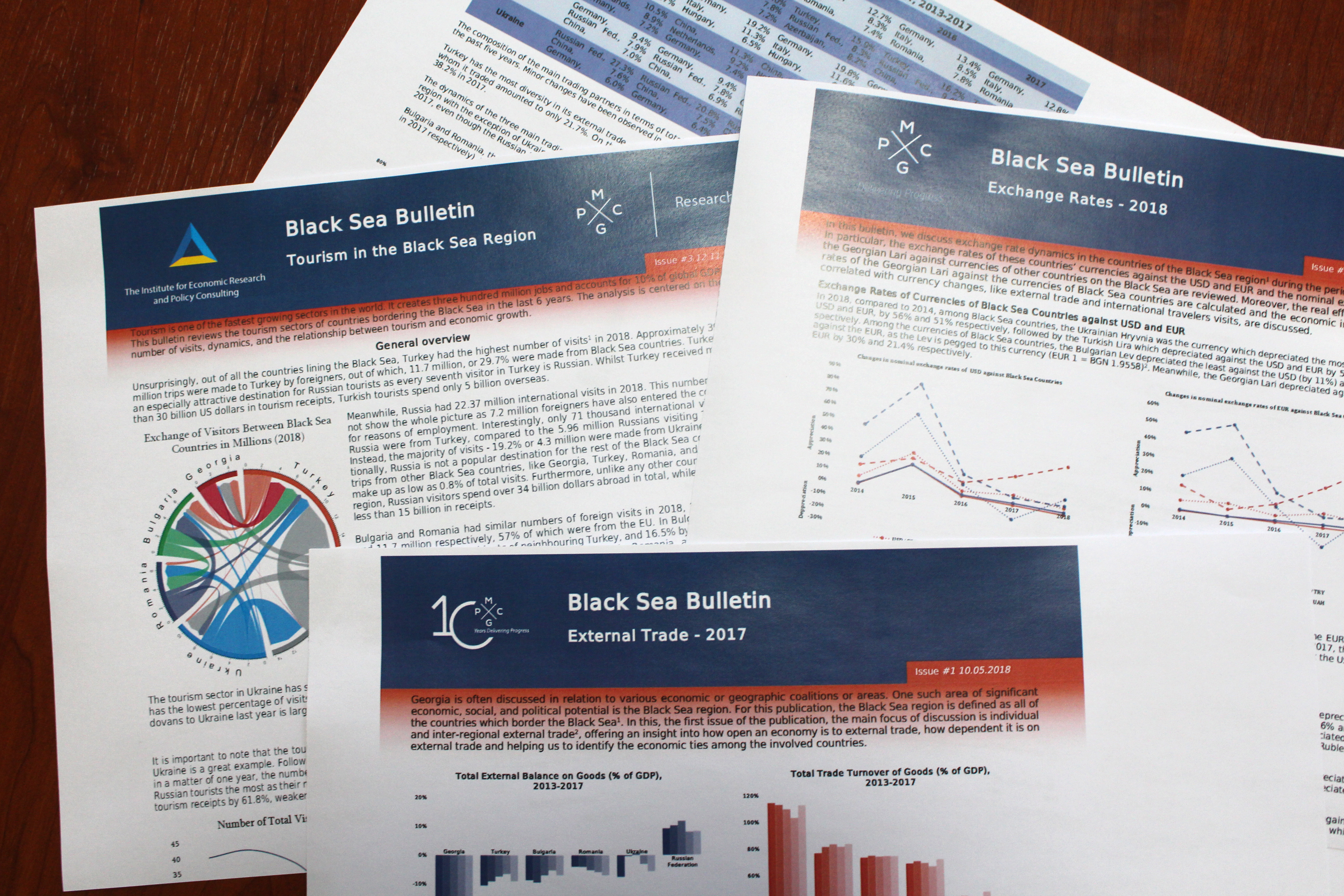

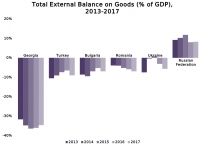

Trade in Black Sea Countries

2024-02-05 00:00:00

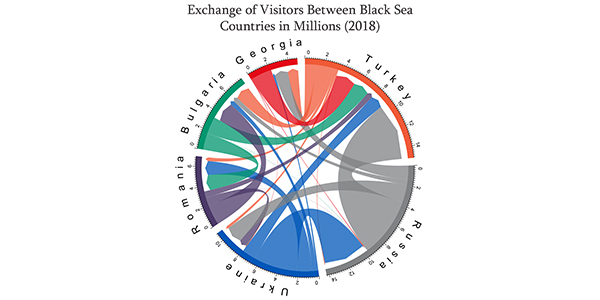

The war in Ukraine has significantly altered trade dynamics in the Black Sea region. Firstly, it has created security challenges and increased tensions between countries. On the other hand, it has also unlocked opportunities to utilize the potential of the Black Sea as a strategic location and international transport route. With this context in mind, it is important to analyze intra-Black Sea countries’ trade, to identify the patterns and volumes of goods exchanged among these countries, and to determine the dynamics of regional economic cooperation and transportation networks. This bulleting provides analysis of the trade data of Black Sea countries and present the main trends in trade in and among Black Sea countries and provides some recommendations on how to both address existing challenges and realize opportunities.

Employment Tracker (December, 2023)

2024-01-23 00:00:00

For the first time in 2 years, the number of published vacancies on jobs.ge showed a year-over-year decline.

The share of persons receiving a monthly salary of 2400 GEL and more doubled in December 2023, compared to December 2022, reaching 39.4%.

In 2023, from July to December, the fastest growing number of vacancies category was finance and statistics.

Monthly Tourism Update (December, 2023)

2024-01-18 00:00:00

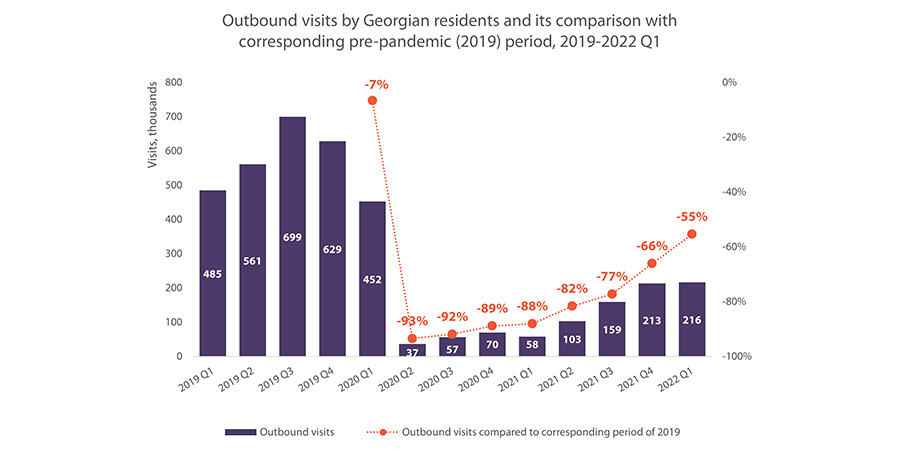

In Q1-Q3 of 2023, the number of outbound visits made by Georgian residents reached 1.6 million, marking a 42% rise compared to Q1-Q3 of 2022. Notably, the number of outbound visits almost recovered to the pre-pandemic level, reaching 95% of the corresponding period of 2019.

In Q1-Q3 of 2023, a significant proportion of outbound visitors chose Türkiye (44%) as their destination, followed by the EU (15%), Armenia (15%), and Russia (12%). Throughout Q1-Q3 of 2023, the number of visits to Russia was the most pronounced since Q2, following Russia’s decision to reinstate the visa-free regime for Georgian citizens and lifting the flight ban in May 2023.

The expenditure of outbound visitors in Q1-Q3 of 2023 reached GEL 1.5 billion, which is 6% lower than in Q1-Q3 of 2019. A shift in expenditure distribution was observed in the covered period, with a significant increase in the share spent on shopping (+10 pp) and a decline in the share assigned to food and drink (-6 pp).

Hotel Price Index (December, 2023)

2024-01-18 00:00:00

In Georgia, the average cost of a room1 in a 3-star hotel was 157 GEL per night in December 2023, while the average cost of a room in a 4-star hotel in Georgia was 253 GEL per night and the average cost of a room in a guesthouse2 was 123 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in December 2023 was 407 GEL per night. In Kakheti, the average price was 547 GEL, followed by Tbilisi – 529 GEL, Guria – 409 GEL, and Adjara – 325 GEL.

BAG Index (Q4, 2023)

2024-01-15 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. In Q4 of 2023, the surveyed businesses assess their present business situation and expectations for the next six months positively.

For the previous reports of the BAG Index, please visit the following link: https://bag.ge/ge/bag-index

Employment Tracker (November, 2023)

2023-12-21 00:00:00

In November 2023, the number of persons receiving a monthly salary increased by 3.9% compared to the corresponding period of 2022.

In November 2023, the share of persons receiving a monthly salary up to 600 GEL amounted to 17.7%, which was 3.5 percentage points less than the corresponding period of 2022.

In November 2023, the share of persons receiving a monthly salary of 9,600 GEL and more amounted to 2.0%, which was 0.4 percentage points more than the corresponding period of 2022.

In 2023, from June to November, the total number of vacancies published on jobs.ge amounted to 44,936, which was 3.7% higher compared to the corresponding period of 2022.

Monthly Tourism Update (November, 2023)

2023-12-15 00:00:00

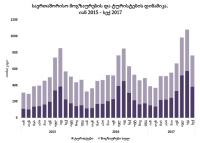

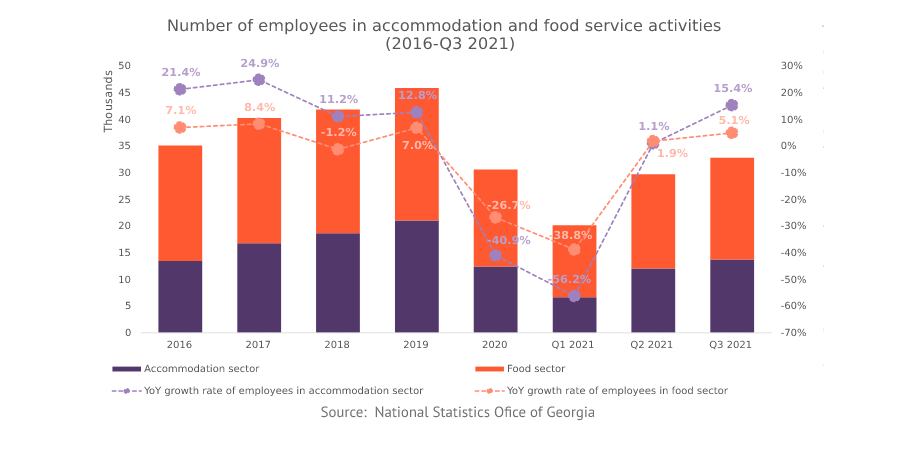

During the first three quarters of 2023, turnover in the Georgian accommodation sector reached 823.9 million GEL, representing a 10.2% increase compared to the same period of 2022. This significant growth can be directly linked to record-high income from international visits in 2023 so far.

In Q1-Q3 of 2023, both the average number of persons employed and the average monthly salary in the Georgian accommodation sector rose compared to Q1-Q3 of 2022 by 5.7% and 11.4%, respectively. Notably, in Q3 of 2023, total salary fund in the sector reached an all-time high, amounting to 26.6 million GEL.

In November 2023, compared to November 2022, the Hotel Price Index (HPI) in Georgia decreased by 13.2%, with the yearly HPI at its lowest under the “guesthouses” category (-21.5%). Meanwhile, compared to October 2023, the HPI in November 2023 dropped by 6.6%.

Hotel Price Index (November, 2023)

2023-12-15 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 143 GEL per night in November 2023, while the average cost of a room in a 4-star hotel in Georgia was 221 GEL per night and the average cost of a room in a guesthouse was 117 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in November 2023 was 386 GEL per night. In Kakheti, the average price was 553 GEL, followed by Tbilisi – 541 GEL, Guria – 358 GEL, and Adjara – 299 GEL.

Georgian Economic Climate (Q4, 2023)

2023-12-12 00:00:00

The main findings of the survey of Georgian economists conducted in the fourth quarter of 2023 are:

Georgian economists have a positive assessment of Georgia’s present economic situation.

Though their predictions for Georgia’s economic situation for the next six months are also positive.

64% of the surveyed economists identified a labor shortage as the most significant threat to the Georgian economy.

All of the surveyed economists either agreed or completely agreed with the IMF’s concerns regarding the independence of the NBG.

Overall, 76% of the surveyed economists believed that the recent developments surrounding the NBG posed a high or very high threat to the continuation of the IMF’s support program in Georgia.

Issue 21: Ukraine’s Monetary Stability: Monetary and Exchange Rate Policy

2023-12-05 00:00:00

Since Russia’s invasion of Ukraine on 24 February 2022, Ukraine has adopted various measures and policies to support business and economic activities in the country. Alongside fiscal policies as well as business and labor support programs, monetary regulations have played a crucial role in ensuring the resilience of its wartime economy.

The National Bank of Ukraine (NBU) has been efficiently responding to monetary developments, implementing effective actions to maintain the country’s monetary stability. This bulletin provides an overview of some of the most recent monetary and exchange rate policies adopted in Ukraine and analyzes their effectiveness by looking at three key monetary stability indicators: exchange rate, inflation, and reserves.

UKRAINIAN PUBLICATION

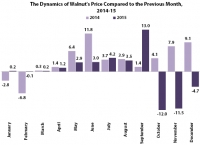

Hazelnut Production Sector in Georgia

2023-11-30 00:00:00

Georgia is a significant contributor to the global hazelnut industry, ranking among the world’s leading countries in both shelled and in-shell hazelnut exports.

Nearly all (97.9%) Georgian hazelnuts are produced in the following five regions: Samegrelo (42.2%); Guria (20.7%); Kakheti (12.9%); Adjara (12.0%); and Imereti (10.5%). Among these regions, the price of hazelnuts is highest in Kakheti, followed by Samegrelo and Imereti.

Most of the hazelnuts produced in Georgia are exported. The leading importer countries of Georgian hazelnuts are Italy and Germany.

Employment Tracker (October, 2023)

2023-11-27 00:00:00

In October 2023, the number of persons receiving a monthly salary increased by 5.1% compared to the corresponding period of 2022.

In October 2023, the share of persons receiving a monthly salary up to 600 GEL amounted to 17.9%, which was 4.6 percentage points less than the corresponding period of 2022.

In October 2023, the share of persons receiving a monthly salary of 9,600 GEL and more amounted to 1.9%, which was 0.3 percentage points more than the corresponding period of 2022.

In 2023, from May to October, the total number of vacancies published on jobs.ge amounted to 45,954, which was 5.1% higher compared to the corresponding period of 2022.

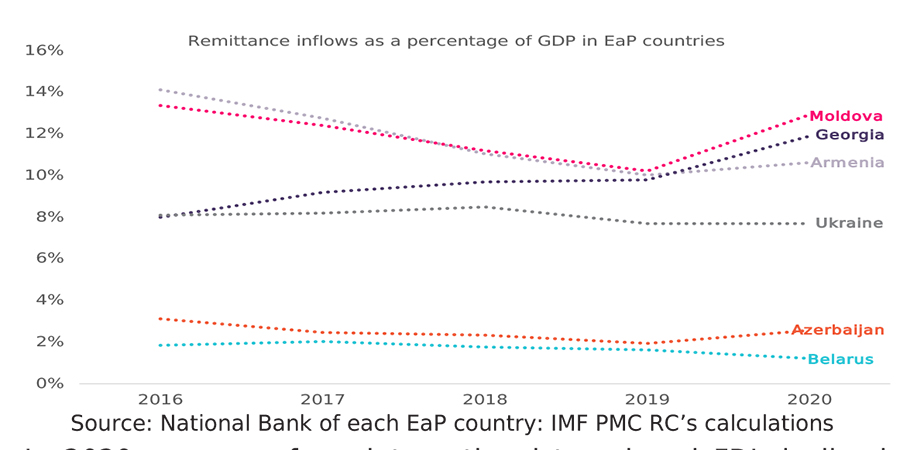

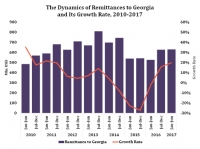

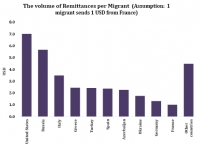

Issue 146: Emigration and the Effect of Remittances on the Georgian Economy (2013-2022)

2023-11-20 00:00:00

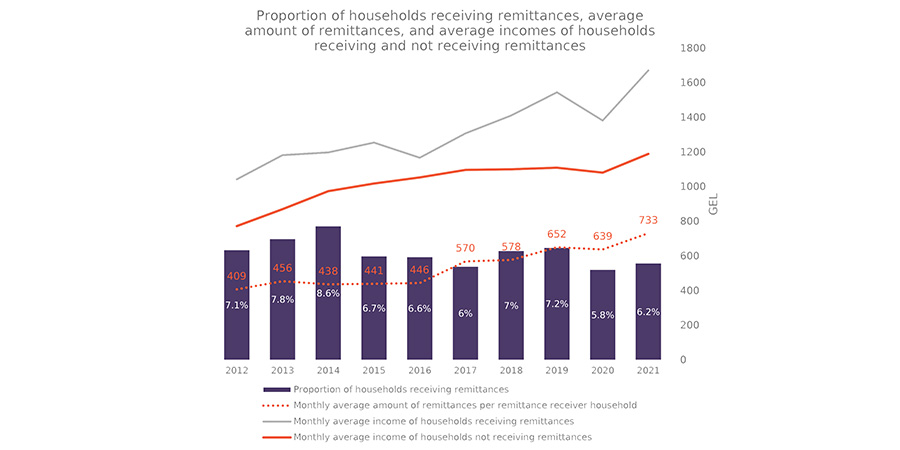

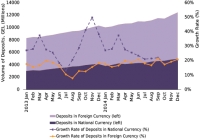

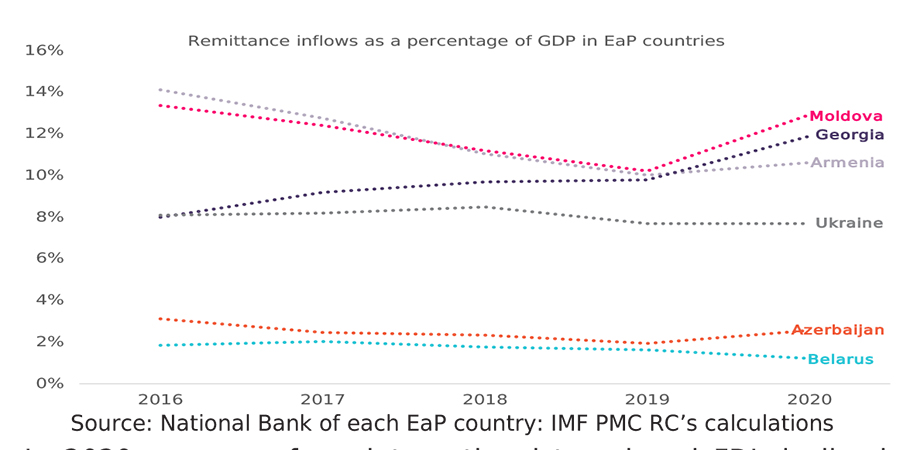

Georgia is considered a country of emigration. Since the mid-1990s, emigration from the country has been largely defined as labor migration, with Georgian citizens seeking better prospects abroad to ease persistent socio-economic challenges at home, including high unemployment, widespread poverty, and low wages.

A distinctive feature of this trend is that a significant proportion of Georgian labor emigrants choose to reside and work illegally in their host countries. Meanwhile, for Georgians who opt to emigrate, their primary motivation for doing so is to earn enough to support their families back in Georgia to whom they send remittances to alleviate economic hardships.

This bulletin discusses Georgia’s emigration trends and the role of remittances in the Georgian economy at macro and micro levels over the last decade.

Monthly Tourism Update (October, 2023)

2023-11-14 00:00:00

In Q3 of 2023, the number of international visits reached 2.3 million visits, recording a 21% YoY increase, however, only reaching 83% of visits in Q3 of 2019.

Among the top countries of origin for international visits, in the following periods, visits from Israel are expected to decline due to geopolitical issues. However, visits from China are set to increase gradually with the new visa-free policy. Additionally, India’s tourism market remains promising, despite some border crossing challenges for visitors.

In Q3 of 2023, income from international travel reached USD 1.4 billion, which significantly surpasses the pre-pandemic number by 28%, however, showing an incremental 5% rise compared to Q3 of 2022.

In October 2023, compared to October 2022, the Hotel Price Index (HPI) in Georgia decreased by 11.1%, with the yearly HPI at its lowest under the “guesthouses” category (-18.7%). Meanwhile, compared to September 2023, the HPI in October 2023 dropped by 11.3%.

Hotel Price Index (October, 2023)

2023-11-14 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 152 GEL per night in October 2023, while the average cost of a room in a 4-star hotel in Georgia was 237 GEL per night and the average cost of a room in a guesthouse was 118 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in October 2023 was 411 GEL per night. In Tbilisi, the average price was 562 GEL, followed by Guria – 530 GEL, Kakheti – 517 GEL, and Adjara – 319 GEL.

Issue 5: Macro Overview

2023-11-09 00:00:00

Following rapid double-digit growth in 2021 and 2022, Georgia's economy in this year is continuing on an upward trajectory, albeit at a slower pace compared to the previous two years.

In the first 9 months of 2023, there were several factors that have contributed to growth slowing down. Moreover, there were several factors that presented challenges and opportunities in the economy - examined within the report in detail.

Issue 5 of the Macro Overview thoroughly explores different aspects of the economy in Georgia and beyond, including:

Economic Growth;

Economic and Business Climate;

Key Macroeconomic Indicators;

Labor Market;

External Sector;

Global Economic Trends.

Employment Tracker (September, 2023)

2023-10-25 00:00:00

In September 2023, the number of persons receiving a monthly salary increased by 3.9% compared to the corresponding period of 2022.

In September 2023, the share of persons receiving a monthly salary up to 600 GEL amounted to 18.6%, which was 4.3 percentage points less than the corresponding period of 2022.

In September 2023, the share of persons receiving a monthly salary of 9,600 GEL and more amounted to 1.9%, which was 0.3 percentage points more than the corresponding period of 2022.

In 2023, from April to September, the total number of vacancies published on jobs.ge amounted to 44,802, which was 5.4% higher compared to the corresponding period of 2022.

Monthly Tourism Update (September, 2023)

2023-10-19 00:00:00

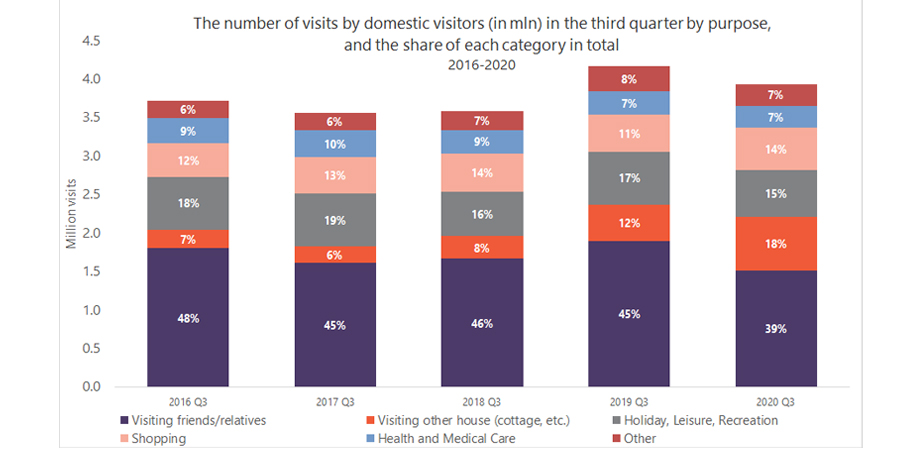

In the first half of 2023, the number of domestic visits amounted to 9.2 million, which is 15% higher compared to the corresponding period of 2022. The upturn in domestic visits this year, following a year-on-year decline in the previous year, was especially pronounced in the Q2 of 2023, where the number of visits rose by 25% compared to the Q2 of 2022.

The total expenditure of domestic visitors reached GEL 1.4 billion in the first half of 2023, which is 14% higher compared to the corresponding period of 2022. By categories, in the first half of 2023, compared to the first half of 2022, the expenditure of domestic visitors on shopping (by 17%) and food and drinks (25%) increased significantly.

In September 2023, compared to September 2022, the Hotel Price Index (HPI) in Georgia decreased by 10.0%, with the yearly HPI at its lowest under the “guesthouses” category (-14.3%). Meanwhile, compared to August 2023, the HPI in September 2023 dropped by 6.2%.

Hotel Price Index (September, 2023)

2023-10-19 00:00:00

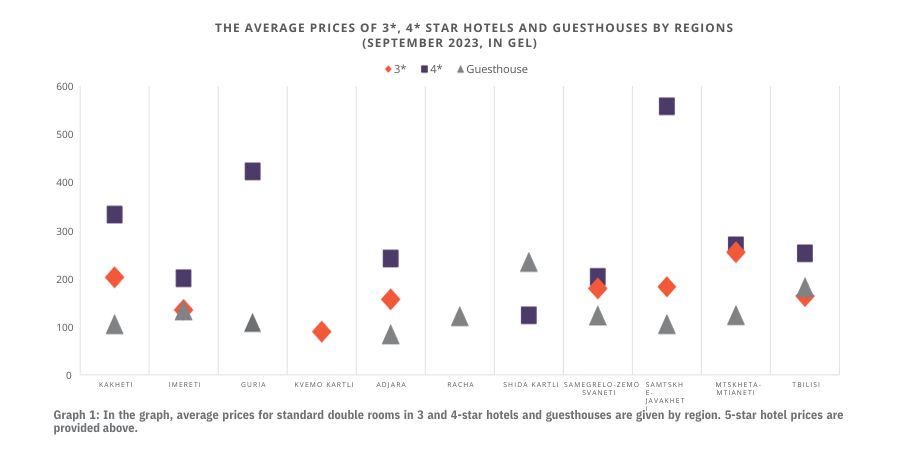

In Georgia, the average cost of a room1 in a 3-star hotel was 168 GEL per night in September 2023, while the average cost of a room in a 4-star hotel in Georgia was 268 GEL per night and the average cost of a room in a guesthouse was 124 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in September 2023 was 495 GEL per night. In Guria, the average price was 780 GEL, followed by Tbilisi – 623 GEL, Kakheti – 514 GEL, and Adjara – 460 GEL.

BAG Index (Q3, 2023)

2023-10-16 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research, and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer, and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. In Q3 of 2023, additional questions were integrated into the questionnaire to assess the investment environment.

For the previous reports of the BAG Index, please visit the following link: https://bag.ge/ge/bag-index

Georgian Economic Climate (Q3, 2023)

2023-10-06 00:00:00

In this bulletin, which is based on the ifo Institute’s methodology, we discuss Georgia’s economic climate, informed by the assessments of various Georgian economists.

The main findings of the survey of Georgian economists conducted in the third quarter of 2023 are:

Georgian economists have a positive assessment of Georgia’s present economic situation.

Though their predictions for Georgia’s economic situation for the next six months are negative.

93% of the surveyed economists think that a labor shortage currently represents a high or very high threat to the Georgian economy.

Almost 78% of the surveyed economists named a high emigration rate as a high or very high threat.

With Turkish Lira hitting a record low, 78% of the surveyed economists think that the decreasing competitiveness of domestic products against cheaper imports from Turkey will have at least a high impact on the Georgian economy.

Employment Tracker (August, 2023)

2023-09-26 00:00:00

In August 2023, the number of persons receiving a monthly salary increased by 4.0% compared to the corresponding period of 2022.

In August 2023, the share of persons receiving a monthly salary up to 600 GEL amounted to 19.1%, which was 4.1 percentage points less than the corresponding period of 2022.

In August 2023, the share of persons receiving a monthly salary of 9,600 GEL and more amounted to 2.1%, which was 0.4 percentage points more than the corresponding period of 2022.

In 2023, from March to August, the total number of vacancies published on jobs.ge amounted to 44,065, which was 10.2% higher compared to the corresponding period of 2022.

Issue 145: Household Income and Income Inequality in Georgia (2013-2022)

2023-09-19 00:00:00

This bulletin provides a comprehensive understanding of household income distribution in Georgia. It presents an analysis of income inequality beyond the traditional Gini coefficient by examining additional dimensions of income distribution. More precisely, the bulletin compares the income of different segments of society, household income in rural and urban areas, and between regions.

Monthly Tourism Update (August, 2023)

2023-09-14 00:00:00

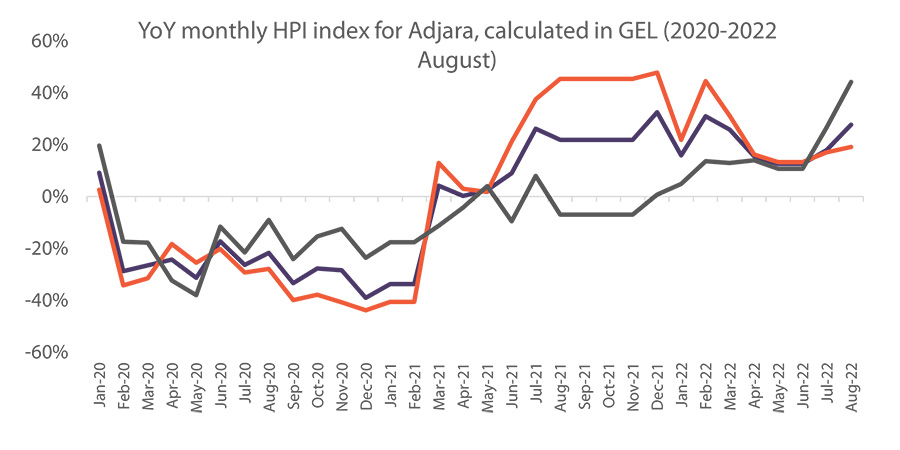

Since the beginning of 2023, the tourism sector in Georgia has been showing signs of significant recovery. Therefore, with this background, it is interesting to analyze the latest hotel price dynamics in Georgia.

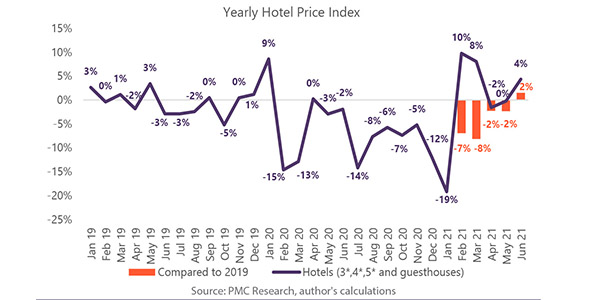

Since the beginning of 2023, the year-on-year (YoY) Hotel Price Index (HPI) in Georgia has experienced notable fluctuations, with a significant decline in the summer months. That drop was mainly attributed to the YoY price decrease for guesthouses.

To provide a better understanding of the latest price changes of hotels, the regional analysis is crucial. In the summer months of 2023, the YoY HPI in Adjara was positive and significant for all categories of hotels (16%) in June, followed by a decline in July (-2.8%) and August (-0.2%). This could partially be attributed to the relatively low demand in seaside locations, in some instances due to visitors’ sea safety concerns.

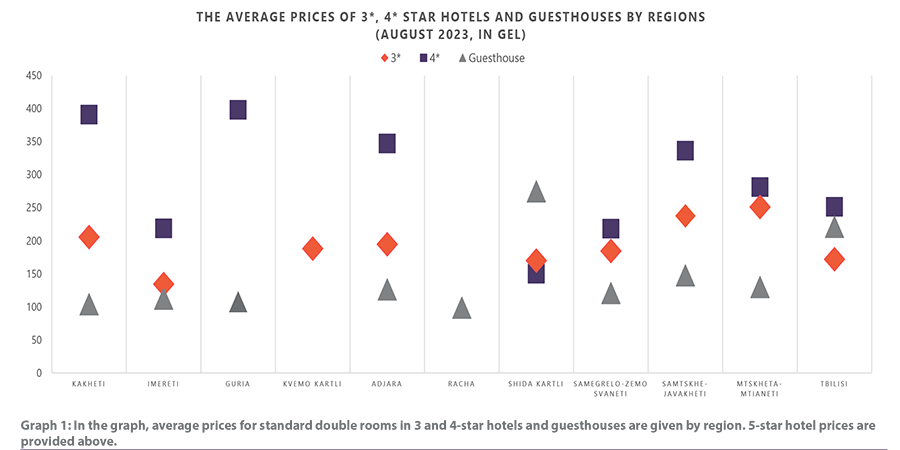

Hotel Price Index (August, 2023)

2023-09-14 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 181 GEL per night in August 2023, while the average cost of a room in a 4-star hotel in Georgia was 278 GEL per night and the average cost of a room in a guesthouse was 130 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in August 2023 was 542 GEL per night. In Guria, the average price was 1055 GEL, followed by Adjara – 515 GEL, Tbilisi – 515 GEL, and Kakheti – 837 GEL.

Employment Tracker (July, 2023)

2023-08-30 00:00:00

In July 2023, the number of persons receiving a monthly salary increased by 4.7% compared to the corresponding period of 2022.

In July 2023, the share of persons receiving a monthly salary up to 600 GEL amounted to 17.1%, which was 4.0 percentage points less than the corresponding period of 2022.

In 2023, from February to July, the total number of vacancies published on jobs.ge amounted to 42,900, which was 12.8% higher compared to the corresponding period of 2022.

In 2023, from February to July, a total of 7,866 vacancies were published in the field of finance, statistics, which was 43.1% higher than the corresponding period of 2022 and 99.0% higher compared to the corresponding period of 2021.

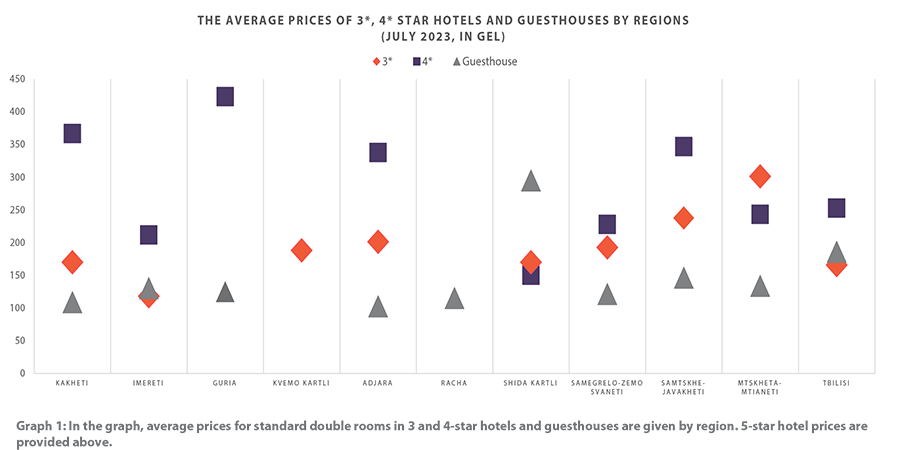

Hotel Price Index (July, 2023)

2023-08-17 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 174 GEL per night in July 2023, while the average cost of a room in a 4-star hotel in Georgia was 267 GEL per night and the average cost of a room in a guesthouse was 132 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in July 2023 was 498 GEL per night. In Guria, the average price was 894 GEL, followed by Adjara – 550 GEL, Tbilisi – 505 GEL, and Kakheti – 466 GEL.

Monthly Tourism Update (July, 2023)

2023-08-17 00:00:00

In the first half of 2023, the number of international visits to Georgia reached 2.5 million visits, which is 21.7% lower than in the first half of 2019 (referred to as the corresponding pre-pandemic figure). This relatively slow recovery could be attributed to the ongoing Russia-Ukraine War and related disruptions to Georgia’s tourism sector.

From a regional perspective, the number of international visits originating from Europe in the first half of 2023 was well below the pre-pandemic number (-23.3%), while for all other regions, the number of visits matched or exceeded the pre-pandemic figure.

Despite only a partial recovery in the number of international visitors in the first half of 2023 against the corresponding period of 2019, income from international travel reached USD 1.8 billion, representing a 24% increase compared to the first half of 2019.

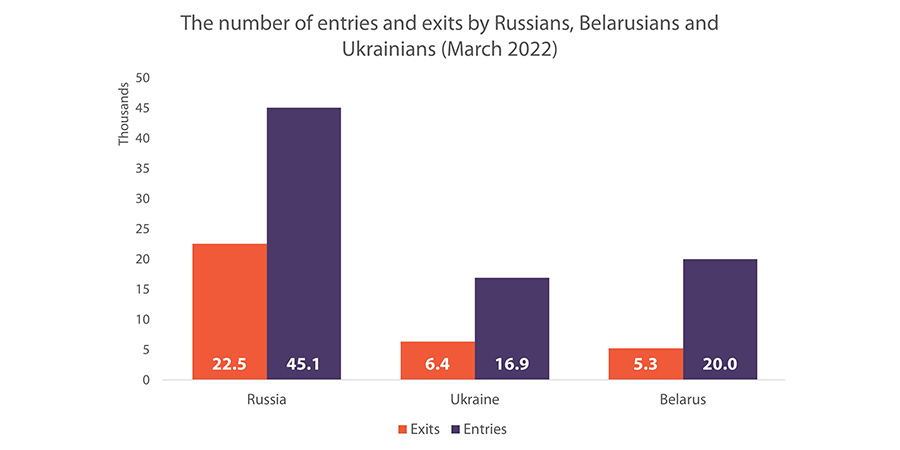

According to the National Bank of Georgia, as of 30 June 2023, 38.4% of Russian citizens, 34.9% of Belarusian citizens, and 28.0% of Ukrainian citizens residing in Georgia were estimated to have been living in the country for at least one year or were intending to stay for more than one year.

Considering these estimates, income from Russian travelers was at its highest in the first half of 2023 when it amounted to USD 482.1 million (equating to 26.7% of total income from international travel), which is 9.4% higher compared to the same period of 2019.

Issue 4: Macro Overview

2023-08-10 00:00:00

Following rapid double-digit growth in 2021 and 2022, Georgia's economy in this year is continuing on an upward trajectory, albeit at a slower pace compared to the previous two years.

In the first half of 2023, there were several positive developments in the Georgian economy, even of these have all come with their own challenges and associated risks – examined within the report in detail.

Issue 4 of the Macro Overview thoroughly explores different aspects of the economy in Georgia and beyond, including:

Economic Growth;

Economic and Business Climate;

Key Macroeconomic Indicators;

Labor Market;

External Sector;

Global Economic Trends.

Employment Tracker (June, 2023)

2023-07-25 00:00:00

In June 2023, the number of persons receiving a monthly salary increased by 4.7% compared to the corresponding period of 2022.

In June 2023, the share of persons receiving a monthly salary of 2,400 GEL and more amounted to 22.6%, which was 5.3 percentage points more compared to the corresponding period of 2022.

In 2023, from January to June, the total number of vacancies published on jobs.ge amounted to 42,075, which was 15.0% higher compared to the corresponding period of 2022.

In 2023, from January to June, a total of 7,799 vacancies were published in the field of finance and statistics, which was 46.4% higher than the corresponding period of 2022.

Hotel Price Index (June, 2023)

2023-07-19 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 186 GEL per night in June 2023, while the average cost of a room in a 4-star hotel in Georgia was 262 GEL per night and the average cost of a room in a guesthouse was 133 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in June 2023 was 485 GEL per night. In Guria, the average price was 646 GEL, followed by Kakheti – 556 GEL, Adjara – 516 GEL, and Tbilisi – 512 GEL.

Monthly Tourism Update (June, 2023)

2023-07-19 00:00:00

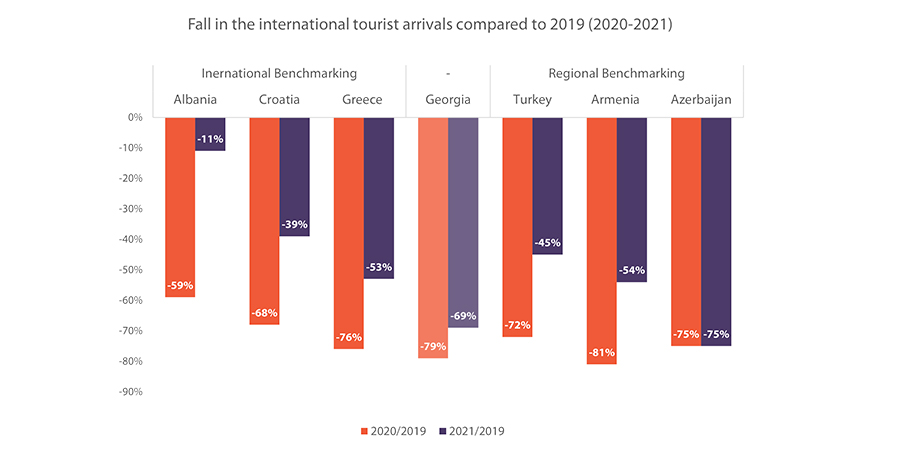

In 2022, the recovery level of international tourist arrivals to Georgia (72%) was higher compared to the averages of the world (63%), and Central/Eastern Europe (59%), yet lower than that of Europe as a whole (80%). The rate of recovery for Georgia accelerated in Q1 of 2023, reaching 96%, above the averages of the world (80%), Europe as a whole (90%), and Central/Eastern Europe (59%).

However, among selected comparable countries in which tourism makes a large contribution to the national economy, Georgia’s performance was not so outstanding in 2022. Specifically, high levels of recovery in the number of international tourists were evident in all such nations, with Albania even exceeding its pre-pandemic figure, followed by Greece and Croatia showing a strong rebound, while Georgia performed the worst among these four countries.

In a regional context, Turkey and Armenia showed better performance regarding the recovery of international tourist arrivals than Georgia both in 2022 and in Q1 of 2023.

Issue 20: Ukraine: Reconstructing International Trade

2023-07-04 00:00:00

In this bulletin, we overview the infrastructural losses Ukraine has suffered from the war so far, the plan for rebuilding the country’s trade infrastructure, the dynamics of Ukraine’s international trade, the facilitation of exports, and the strengthening of the country’s economic resilience with the assistance of external actors.

Georgian Economic Climate (Q2, 2023)

2023-06-27 00:00:00

The main findings of the survey of Georgian economists conducted in the second quarter of 2023 are:

Georgian economists have a positive assessment of Georgia’s present economic situation.

Though their predictions for Georgia’s economic situation for the next six months are negative.

63% of the surveyed economists think that Russia’s war on Ukraine as well as labor market problems like skills mismatch and labor shortage (lack of qualified personnel) currently represent a high or very high threat to the Georgian economy.

More than one year since Russia launched its war on Ukraine, nearly half (47%) of the surveyed economists claimed they are uncertain about how to assess the overall impact of the war on the Georgian economy.

Almost 90% of the economists agree with the decision of National Bank of Georgia (announced on 10 May, 2023) to loosen its monetary policy and decrease the policy rate by 0.5 percentage points from 11% to 10.5%.

Employment Tracker (May, 2023)

2023-06-22 00:00:00

In May 2023, the number of persons receiving a monthly salary increased by 7.0% compared to the corresponding period of 2022.

In May 2023, the share of persons receiving a monthly salary of 2,400 GEL and more amounted to 21.3%, which was 4.7 percentage points more compared to the corresponding period of 2022.

From December 2022 to May 2023, the total number of vacancies published on jobs.ge amounted to 39,630, which was 17.6% higher compared to the corresponding period of 2021- 2022.

From December 2022 to May 2023, a total of 10,495 vacancies were published in sales, procurement, which was 11.2% higher compared to the corresponding period of 2021-2022.

BAG Index (Q2, 2023)

2023-06-20 00:00:00

The Business Association of Georgia (BAG) Index is a joint product of the Business Association of Georgia, PMC Research and the ifo Institute for Economic Research. The BAG Index summarizes the BAG Business Climate, BAG Employment Barometer and BAG Investment Environment, which are calculated according to the assessments of the top managers of BAG member businesses and companies in their corporate group. In Q2 of 2023, additional questions were integrated into the questionnaire to assess the effect of the removal of some industries from the list of sectors with specific operating conditions on businesses. BAG and PMC Research publish the BAG Index on a quarterly basis from Q4 2019.

For the previous reports of the BAG Index, please, visit the following link: https://bag.ge/ge/bag-index

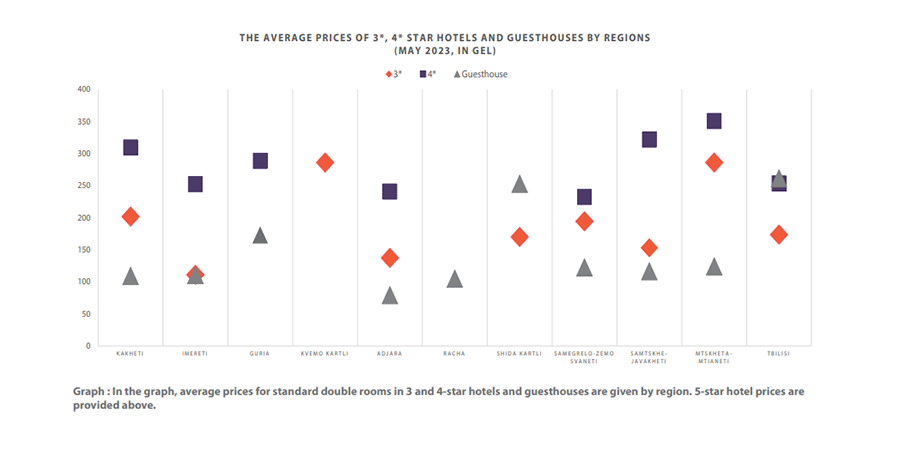

Hotel Price Index (May, 2023)

2023-06-12 00:00:00

In Georgia, the average cost of a room in a 3-star hotel was 166 GEL per night in May 2023, while the average cost of a room in a 4-star hotel in Georgia was 270 GEL per night and the average cost of a room in a guesthouse was 124 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in May 2023 was 409 GEL per night. In Guria, the average price was 584 GEL, followed by Tbilisi – 515 GEL, Kakheti – 354 GEL, and Adjara – 369 GEL.

Monthly Tourism Update (May, 2023)

2023-06-12 00:00:00

In Q1 of 2023, 1.05 million passengers were transported by airline companies in Georgia, which is 3.3% higher compared to the corresponding pre-pandemic (Q1 of 2019) figure.

Despite significant YoY growth, the number of passengers traveling to and from Tbilisi airport did not fully recover to pre-pandemic levels (-11% compared to Q1 of 2019), while the number of passengers traveling through Kutaisi and Batumi airports exceeded pre-pandemic numbers significantly.

Throughout the winter season of 2022-2023, regular flights to and from Georgian airports were provided by 41 airlines on 61 routes. The average number of flights per week over this period was 390, which is 6% lower compared to the scheduled weekly flights for the winter season of 2018-2019.

In the summer season of 2023, the number of airlines is expected to rise to 43, while the number of routes is expected to increase to 88. The average number of weekly flights will reach 555, which is 42.3% higher compared to the previous season, and 5.9% lower compared to the number of scheduled flights in the summer season of 2019.

Inflation and Monetary Policy in Black Sea Countries

2023-06-08 00:00:00

Since mid-2020, when stringent restrictions were imposed to combat the spread of the COVID-19 pandemic, inflation has been running at multi-decade highs in many countries across the globe. In 2022 in particular, inflationary pressures from pandemic-related disruptions were exacerbated by the Russo-Ukrainian War and spiking food and energy prices. In response, central banks implemented different monetary policy approaches in an attempt to stabilize the situation. Against this background, recent inflationary trends and monetary policy approaches adopted by economically diverse Black Sea countries are analyzed and compared in this issue of Black Sea bulletin.

Employment Tracker (April, 2023)

2023-05-30 00:00:00

In April 2023, the number of persons receiving a monthly salary increased by 3.7% compared to the corresponding period of 2022.